Inflation is a real problem…. in America.

It recently reached levels not seen for 40 years….in America.

However, not everywhere is suffering the same degree of inflation as America.

The term ‘banana republic’ depicted politically unstable countries, often in the Caribbean, Pacific or Atlantic with economies hostage to inflation shocks and with political systems exhibiting democracy deficits. The term was coined by American author, William S Porter, who, like T S Eliot and others, had subsidised writing by working a day job working at a bank. It was coined to describe neighbouring republics (at that time Honduras but also Guatemala, Colombia Costa Rica, Ecuador, Panama, Nicaragua, El Salvador, Southern Mexico and perhaps most famously, Cuba) exploited by US corporations such as United Fruit Company, Standard Fruit Company and Del Monte (organisations that variously combined predatory capitalism, corporate imperialism, wage slavery, environmental vandalism and which also provided fronts for the CIA). Socio-economic inequality was a major factor in banana republicanism, with large, labour forces, whose wage slavery was exploited by a combination of state capitalism and quasi-monopolistic corporations, exercising extreme pricing power, working hand in hand to exploit public and natural resources for the benefit of a very small minority . Banana republics historically tended to also run high levels of public and private debt, the latter distributed extremely unequally.

The worst inflation in the Americas continues to be experienced by Argentina and Venezuela – largely a legacy of political ‘punishments’ inflicted mainly by the USA, but also, in the case of Argentina, originally very much aided and abetted by the UK too – and also by Brazil Chile and Paraguay which have very specific supply chain issues and typically are prone to higher inflation.

Source: FT, MBMG Investment Advisory

The 2 next worst inflation offenders are the former banana republics of Colombia (9.1%) and Costa Rica (8.7%). However, beyond that, as can be seen from the chart above, the picture is interesting. These are then followed by none other than USA at 8.6%! The former banana republics of Honduras (8.3%), Mexico (7.7%), El Salvador (7.5%), Nicaragua (6.4%), Guatemala (4.6%), Panama (3.6%) and Ecuador (2.9%) are all reporting lower inflation than America!

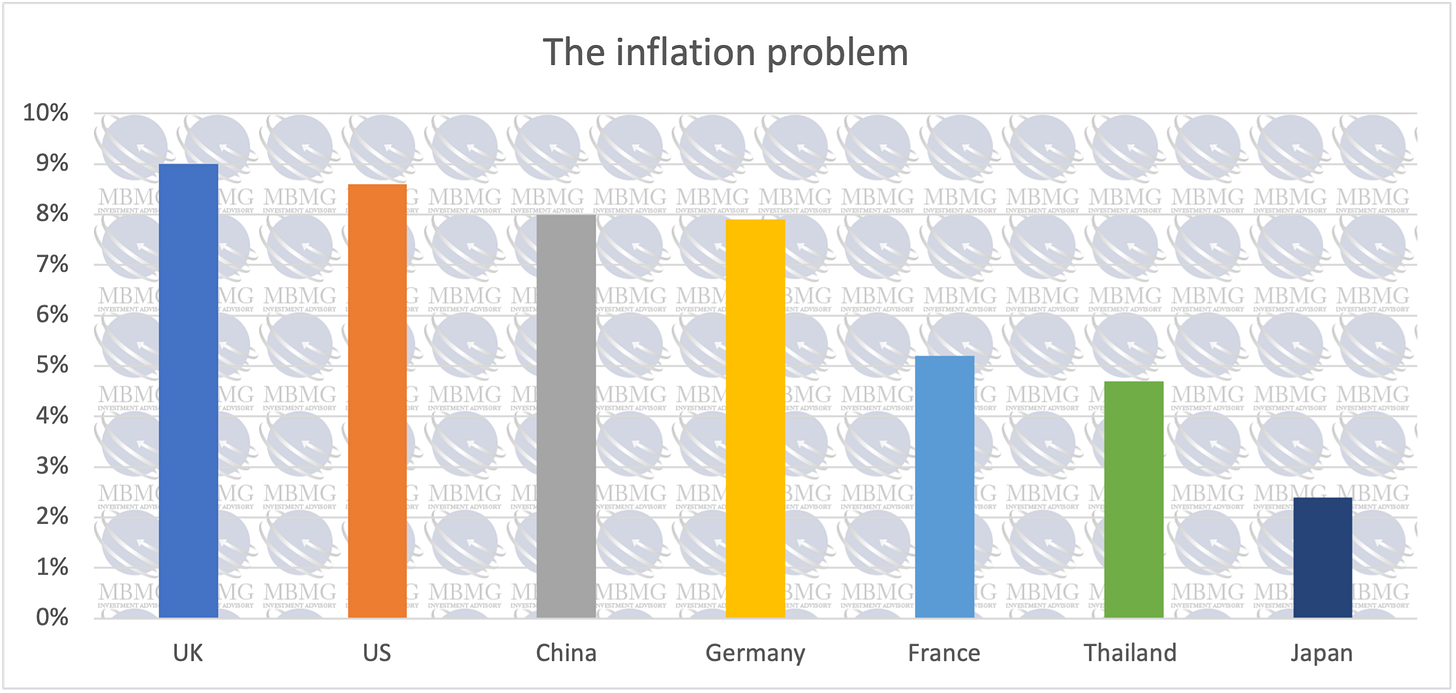

In a global context, things don’t look much better. Admittedly Ukraine inflation at 16.4% now outstrips America’s and the UK (AKA Boris’ Island) is slightly higher than America’s (9%), presumably due to importing all the wine and cheese for the Downing Street parties during lockdown. Russia’s inflation rate looks high year on year, but the latest data extrapolated on an annualised basis suggests that inflation in Russia is below 1.5%. Internationally, America is uncomfortably close to the top of the league:

Source: FT, MBMG Investment Advisory

Initial triggers for inflation were actually not an undue cause for concern, as we pointed out at the beginning of the year : Firstly, this was primarily an American problem-

“Because obviously the USA is the major economy in the world and because the Fed is the primary policymaker, we've all got a little bit obsessed with the US story, but actually inflation is primarily a US story. If we look at the rest of the world, most of high inflation in other countries is a weak currency or an idiosyncratic supply chain issue.”

Secondly, it reflected the fact that in the US, policymakers had supported consumption, the key driver of US economic activity, during the lockdowns and COVID disruptions of 2020 and 2021. Being a significant net importer, supporting consumption in this way, exacerbated supply shock inflation in US CPI far more so than in less consumerist economies.

In fact, in the first quarter of this year, we could see that supply shock inflation was beginning to dissipate.

Then something happened. On February 24th, Russian forces launched operations against Ukraine. Conflict between Russia and Ukraine has been ongoing since 2014 but in view of the strategic importance of Ukraine as a supplier of goods and commodities, many of which are difficult to substitute, this escalation was bound to create some added degree of supply shock inflation.

To the extent that many of Ukraine’s exports can be substituted, the most obvious alternative source in many cases is Russia. While some sanctions had been threatened and even implemented in the months prior to February 24th (primarily by USA, UK, Germany, Australia, Japan and the EU), since then over 25 countries plus the European Union have implemented almost 200 actions that amount to various sanctions.

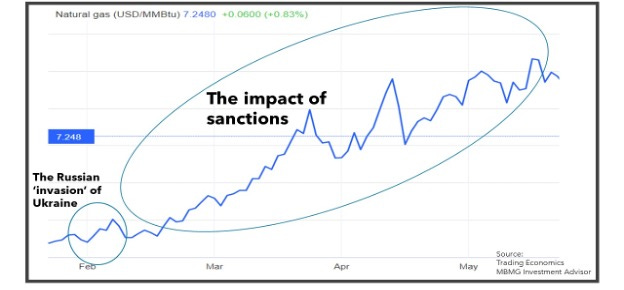

The combined effect of these has been to further disrupt the supply of goods, services and resources. Natural gas prices moved up from around $4.30 per million BTU (British Thermal Units) a week before the incursion, to $4.60 on February 24th,they subsequently fell back again to end February at $4.40. However, the effect of sanctions drove these to the highest levels in almost 15 years ($9.32) earlier this month. Although they fell back from this peak, they remain elevated and currently climbing again.

Natural gas prices

In short, the inflation that we’re seeing was initially caused by supply shocks. It affected America far worse than most economies because of the US twin reliance on imports and consumption and because monetary and fiscal policy had underwritten consumption during the challenges of 2020 and 2021.

The supply shocks were beginning to dissipate but were given a jolt by the escalation of the Ukraine-Russia conflict. This was abating, when it was driven exponentially higher by sanctions from NATO nations and their closest allies.

The extent of the determination of these nations to continue to double down has slightly surprised us. The extent to which policymakers of these nations have cornered themselves has also surprised us. Policymakers have admitted that monetary policy is the wrong tool to use because it is ineffective to deal with supply issues and because in reducing aggregate demand, that will have limited impact on supply shock inflation but will reduce aggregate demand and cause the global economy to slow down, thereby risking causing a recession (which at such high levels of private debt has the potential to develop into a full-blown depression).

It's particularly worrying that US policymakers are so determined to risk a recession (and depression) by using the wrong tools partly because this is an avoidable potential risk and also because the global consequences of a US recession, let alone depression would be so severe (it’s long been said that when America sneezes, the world catches a cold – we believe that the Chinese economy may have some immunity from this but not having yet emerged from zero-COVID, their susceptibility or not remains far from certain).

Also, the global capital market consequences of tighter US monetary policy (higher USD interest rates, less Dollar liquidity sloshing around) is a major impediment to asset prices in America and globally. Next time that Pres. Biden tries to pin the blame for this on others, we’d hope that Mrs. Biden will send him one of her famous ‘fexts’ calling him out on this. Others have fact-checked Pres. Biden’s claims and reached similar conclusions , even though they admit that it’s tempting to scapegoat Pres. Putin at this time-

“If I was Biden I would do the same. I would blame someone else external, that has nothing to do with me. Last year was Xi Jinping, this year it is Putin” – Prof. Michele Geraci

As always, politics is the main game in town, and as so often, risks causing extremely damaging consequences.

Takeaways

Supply shock inflation can’t be cured by tighter monetary policy.

Tighter monetary policy can slow global growth, and possibly cause a recession.

A recession at this stage in the economic cycle could spiral into a full-blown depression.

Economic and geo-political policy mistakes by the Federal Reserve, US Treasury and Biden administration are entirely avoidable and the prime cause of major risk facing the US and global economy and capital markets.

Notes

The United Fruit Company today operates as Chiquita International, co-owned by the privately held Sucocitrico Cutrale and J Safra Group

Del Monte Inc., was acquired in 2014 and is now a Singapore-listed Filipino conglomerate, Del Monte Pacific Limited

The Standard Fruit Company is today part of the NYSE listed, Dublin-headquartered conglomerate, Dole Plc.

[1] O'Connor, R., 1970. O. Henry: the legendary life of William S. Porter. 1st ed. New York: Doubleday.

[2] CHAPMAN, P., 2022. BANANAS. [S.l.]: CANONGATE BOOKS LTD.

[3] https://www.nytimes.com/interactive/2019/08/14/magazine/slavery-capitalism.html

[4] https://www.ft.com/content/088d3368-bb8b-4ff3-9df7-a7680d4d81b2

[5]

[6] https://www.piie.com/blogs/realtime-economic-issues-watch/russias-war-ukraine-sanctions-timeline

[7] Jill Biden recently admitted sending critical or angry messages to her husband, which she describes as ‘fexts’ - https://www.theguardian.com/us-news/2022/may/31/jill-biden-joe-first-lady-texting-harpers

[8] https://edition.cnn.com/videos/business/2022/06/14/inflation-biden-economy-blame-ukraine-war-putin-foreman-dnt-vpx-lead.cnn https://www.factcheck.org/2022/05/bidens-economic-spin/

[9 ] https://www.newsweek.com/fact-check-joe-bidens-putin-price-hike-inflation-claim-accurate-1715647

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.