Welcome to the thankfully penultimate meandering in this series of articles examining how policy dysfunctionality has affected labour and consumer ‘agents’ within the US and global economies.

If you’re exhausted by this, apologies. If bizarrely you’re sad that this detour de force is reaching a conclusion, we’ll try to wean you off this by running a minis-series next week of our observations of the Feds talking through their Jackson Hole.

Today, we’ll dig deeper into examples of Fed dysfunctionality:

Instead of providing clear guidance, the Fed now claims to formulate policy in response to data, without ever making it clear what value or weight is ascribed to particular data points. This creates the second derivative market response of outsize reactions to every data point and extreme reactions to outlying data points, in anticipation of what these data might mean to policymakers:-

“The market only cares about first release Non-farm payrolls — knowing the number is more important than the truth!” – Michael W Green’s summary of institutional and hedge fund investors.

The Fed remain blinkered – obsessing on data releases such as non-farm payrolls are significant masks more empirical and varied indicators of the structural slowdown:-

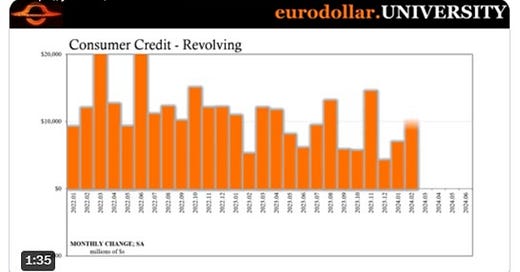

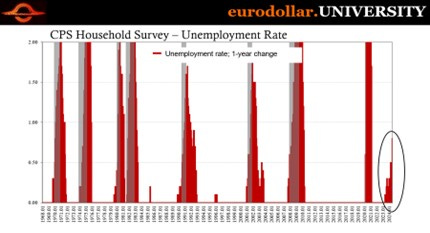

“US consumers have been pulling back on revolving credit since March. Same time unemployment has become a problem, and the economy's strength and resiliency somehow disappeared. Clear recession signal tied to workers’ perceptions of the labor market.” - Jeff Snider, EuroDollar University (whose work on labour market data is always thought-provoking and insightful) :

3. The point about workers’ perceptions is well made. Consumer confidence has remained muted – leading economist to dismiss consumers’ fears as misplaced – which begs the question, why bother to survey consumer confidence if you dismiss the survey results when they don’t chime with policymakers’ narratives? In the Fed’s defence, US employment data is uniquely challenging for various reasons.

4. Part of the data fallibility is its inability to keep up with structural changes in the US labour force. The American economy has long been lauded by mainstream economists for the flexibility of its labour force. Almost a quarter of a century ago, ILO’s Paul Osterman warned that this really meant a diminution in employee rights and security. (https://www.ilo.org//media//305746)It doesn’t take Einstein to figure out that the reduction in employee rights and security plays at least some role in the curtailment of labour bargaining power that has seen labour share of economic profits fall over the same period and it’s a logical leap from there to the assertion made by Danny Blanchflower &David Bell for the NBER (https://core.ac.uk/download/pdf/237669851.pdf ) that underemployment is a more relevant economic indicator than unemployment. For cultural, socio-political and historical reasons, the prime US labour force data remains the U3 reading, which pretty much disregards these nuances (Investopedia provides a highly readable simplified introduction to this topic, including the following “U-3 is often criticized for being too simple. Many economists believe it fails to take the whole picture into account because it includes only people who are actively seeking employment. It actually excludes individuals who work part-time but want full-time work and discouraged workers……who are able to work but haven't looked for a job for the last four weeks.” (https://www.investopedia.com/articles/investing/080415/true-unemployment-rate-u6-vs-u3.asp) Investopedia also adds “The official unemployment rate is known as the U-3 rate or simply U3. It measures the number of people who are jobless but actively seeking employment. The rate is measured by the BLS, which contacts 60,000 randomly selected households across the country and records the employment status of each person 16 years old and older. The information gathered by the agency through surveys and social insurance statistics (which reflects the number of people who are drawing unemployment benefits) is published each month, giving a picture of the employment status of the nation's working population. The unemployment rate is a lagging rate. It changes months after an economy changes directions. It moves higher when an economy experiences hardships and moves lower when the economy strengthens.” In addition it should be noted that there are further problems with the official or establishment US unemployment survey methodology-

“High-frequency data tends to be noisy. The establishment survey projects the best-case scenario and throws out the January number. The labor gains have been slowing down to begin with, but then you look at some of the rest of the data, including the household survey for employment. Adjusting for the population control factor and some of the statistical stuff that gets thrown up every year with benchmark annual revisions, what you see is that the household survey has been behaving very differently from the establishment survey. The picture of the labor market from the household survey looks like the beginning stages of a recession, whereas the establishment survey looks like everything is fine. This huge discrepancy is even within BLS data series, where one looks like what the markets are pricing, and the other looks like what the Federal Reserve wants it to. The most important part is the household survey for full-time employment, because before we get into any actual contraction, companies will be careful. They'll see a small drop in demand and revenue, slightly less profits, and won't respond immediately by firing all their workers. Instead, they'll start managing their cost structure more carefully. They may institute hiring freezes or cut back hours from some of their existing workforce….This is generally what happens before each recession. The level of full-time jobs, which was expanding beforehand, doesn't immediately shift into contraction. It goes through this multi-month rollover process where businesses stop hiring and cut back on their hours before they start letting go of lots of workers.” – Jeff Snider (https://www.macrovoices.com/guest-content/list-guest-transcripts/4950-2023-02-09-transcript-of-the-podcast-interview-between-erik-townsend-and-jeff-snider/file) It would appear that this ‘roll over’ process is now in place

Hiring slowdown -> Reductions in hours -> Lay offs

5. Additional data challenges also fail to take into account other factors including the emergence of the gig economy.

6. The slavishly obsessive reliance by policymakers on U3 data promotes a highly misleading, typically overly positive, over simplified view of labour markets:- “The unemployment rate is often the most charitable view of the labor market (participation problem) so when that turns bad that means the best view we have of employment is already in recession.” – Jeff Snider, EuroDollar University:

The Fed have made it very clear that their main priority is inflation and that they would rather risk causing a recession than cause inflation (even though that’s exactly what they did in 2021), in blatant disregard of the supposedly dual mandate of stable prices and full employment.

Despite the Fed-induced catastrophe of the GFC and a history of continual serious policy failings (we have previously demonstrated how the Fed has caused recessions following every instance of inflation since WWII and also cited Senator Warren’s analysis that the Fed have not even once managed to avoid causing major unemployment spikes following every inflation event), the Fed still seem to believe in their own infallibility and manage to transmit this misplaced faith in their own (in) competence to the markets. The Fed embodies the lack of self-awareness that leads to inflated perceptions of self-competence that underlies the Dunning-Kruger effect (“The Dunning-Kruger effect occurs when a person’s lack of knowledge and skill in a certain area causes them to overestimate their own competence.”- Pilat and Krastev, The Decision Lab

This lack of self-awareness extends to even the practical consequence that analysis by a lack of cognizance of the feature highlighted by Gerry Brady of Boom Finance and Economics that “The Fed tend to be much more effective at applying the brakes than the accelerator.”

We’ll look at the increasing awareness of the Fed self-delusion among other commentators and try to tie all of this together in tomorrow’s final instalment.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum.