More observations…..

Although it was actually only around 3 weeks and 4 episodes of MBMG Flash ago, you’d be forgiven for thinking it was far, far longer than that since we embarked on sharing some thoughts from recent presentations about the merciful denouement of 2022 and trepidation about what the plot for 2023 holds in store.

For anyone still standing after our detour into the Slough of Disinflation (or not), we’ll know tackle the lighter topic of capital market dysfunction.

Markets generally haven’t had the best of times in 2022 (that observation should probably be attributed to Captain Obvious):

Broad indices, such as the S&P 500 or the All Countries World Index, look set to end the year around -20% lower, which is what we’d see as typical of the kind of decadal setback that recurs every 10 years or so:

Source: https://www.macrotrends.net/2526/sp-500-historical-annual-returns

Such decadal setbacks can vary significantly in scale -the more major decadal events have typically involved either a greater scale of drawdown (such as the GFC that mainly centred around 2008) or have spread across a number of years, such as the ‘tech-wreck’ of 2000-2002.

However, the kind of once in a lifetime events suffered by the global markets following the Wall Street Crash of 1929 (or by specific markets such as the UK from 1973-75, Japan after the 1989 crash or South East Asia following the Tom Yam Gung Crisis of 1997), are much less frequent and are characterised typically by a combination of more severe drawdowns that continue over many years.

Two things that we can be certain of (and there aren’t too many certainties right now) are that

1. This isn’t yet of the scale to constitute a lifetime event (from 1929 to 1932, the Dow Jones Industrial Average fell by over -90%).

2. We can’t yet rule out that the 2022 ‘crash’ could become a lifetime event.

Whether or not we move from a bad year to a catstrophic few years remains to be seen. In our view, it is entirely avoidable but that isn’t the same as stating that it will be avoided.

As we explained in a recent Flash Note[1], policymakers’ actions have largely supported asset prices long before the S&P fell to the beastly intra-day low of 666 in March 2009 (not that we’re saying that this was the right thing to do, it almost certainly wasn’t) and increasingly so since then.

“policymakers are not normal people and decided in their finite and misguided ‘wisdom’ to create government funds to be used to fund the rehabilitation of the financial sector. The United States did this better than anywhere.

The adoption (the sharp spike up in Federal Reserve assets in late 2008 in the chart below) of aggressive Quantitative Easing (QE) initially resulted in the Federal Reserve buying (and therefore effectively rehabilitating) troubled mortgage securities of banks.

The Fed had indicated that it would more than double its balance sheet to $2 trillion by buying over $1 trillion of ‘assets’.”

This helped put a floor under US capital markets, underpinning a rebound in stocks, credit, property and treasuries:

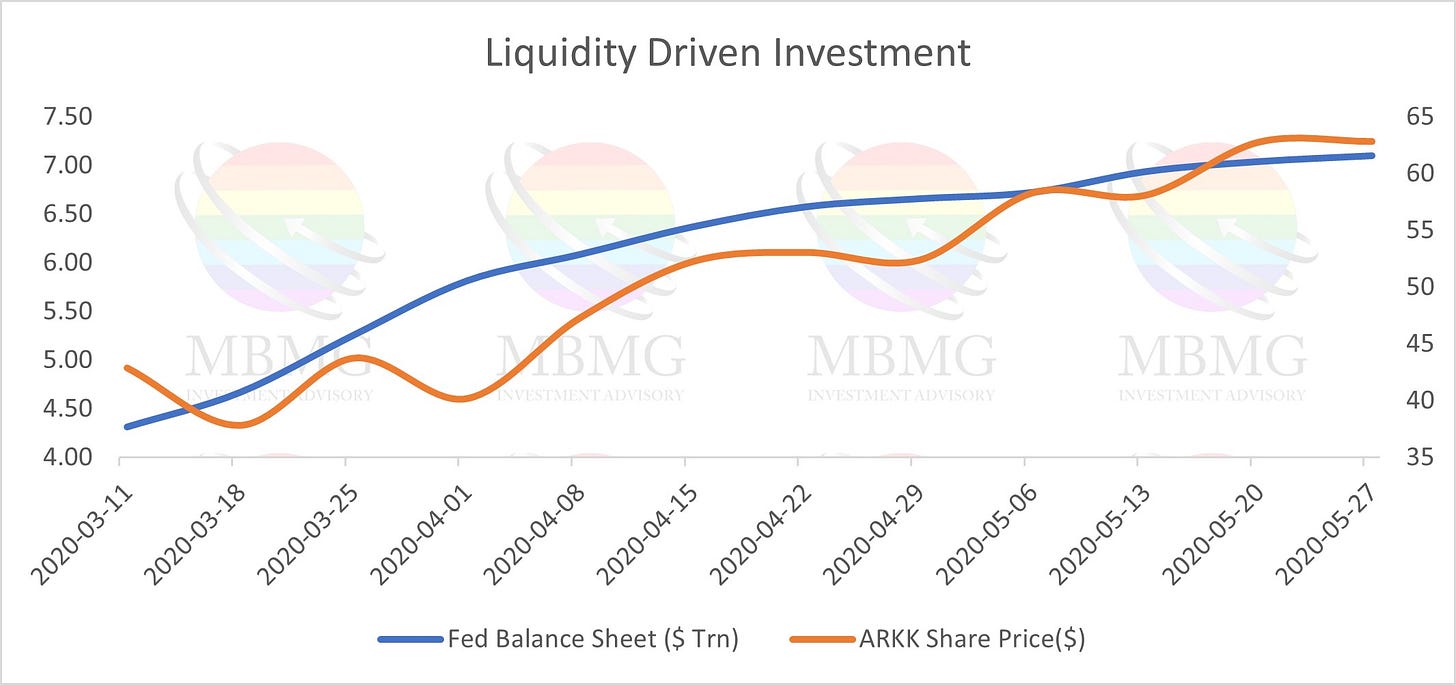

We noted that “it’s insufficient for there simply to be enough liquidity….it also has to be in the right places. What was largely seen as a ‘plumbing problem’ (i.e. sufficient funds unable to get to where it’s needed quickly enough) was ‘solved’ by the Fed’s now default policy of more QE (this should have been designated QE4 in case you’re still keeping count but everyone quickly forgot about this because of what happened next - COVID arrived…….

Today, that leaves a world where asset prices remain hugely interconnected, massively dependent upon liquidity, have been inflated by government largesse (as opposed to leverage - government debt owed in the government’s own currency isn’t really debt), and remain vulnerable to exogenous shocks, such as higher oil prices or spiking supply shock inflation).”[2]

The first symptoms of the removal of liquidity/tighter fiscal and monetary policy were always likeliest to be seen in the bubbliest parts of capital markets, such as Crypto, ARKK, and meme stocks. Weakness in these parts of the market have become gradually apparent at various times since the beginning of last year.

If policymakers had wanted to perpetuate the bubbles that they had created, they could have prevented this weakness. It should be inferred that at the very least since last year, their rhetoric indicated that they wanted to let out some of the air. By the start of this year, with that process well under way, and despite the shock to capital markets of geopolitical tensions, elevated to arguably the highest levels since the peak of the Cold War, policymakers continued to ramp up tightening talk and to enact tighter policy.

While this has resulted in the huge outflows of air from the bubble assets shown in the previous chart (ARKK, BTCUSD and TSLA having fallen between -65% to -80% from peak levels), and has created a typical, decadal broad equity event, it has had unprecedented impacts in other asset classes.

The speed of FOMC tightening has caused what Morningstar’s John Rekenthaler categorised as the “Worst. Bond. Market. Ever.”[3]

Echoing our point that the equity correction isn’t yet of the scale to constitute a significant event, Rekenthaler agrees that barring substantial further losses, the stock market’s decline will soon be forgotten, buried in a database for future internet columnists to disinter” before adding “the bond market’s downturn will long be remembered. The after-inflation loss for intermediate-term government bonds has been even greater than during the second oil crisis that ran from 1979 through 1981, when 10-year Treasury yields peaked at 15.8%.”

The combination of bond market losses that at the long end have exceeded equity market losses[4] and decadal equity losses, along with negative returns in precious metals, credit and property has been challenging for portfolios in 2022, with the average private wealth manager US Dollar portfolio having lost -14.9% this year.[5]

For 2023, the outlook for US treasuries largely reflects the interest rate outlook. While treasuries could be re-rated (either up or down), the odds of a significant re-rating strike us as low. Excluding such effects, bond returns have a reasonable mathematical relationship with long-term rates. Long-term interest rates have a reasonable relationship with long-term economic growth rates. Disregarding these frictions and assuming that nothing has changed with regard to long-term growth rate expectations since the pre-pandemic old normal, total returns on long-term treasuries would be expected to be 25-45% over the period of mean reversion. If long-term growth prospects have been impaired in any way, such as by the recession that is being increasingly feared will onset in 2023-24, these returns might be higher - as high as 65% if fears of slowdown analogous to those that gripped markets during the second and third quarters of 2020 were to resurface.

For risk assets, the picture is less clear. It’s possible that there may be some way back for some of the more fragile assets of the last year or two – but some of the worst casualties may have already been irreparably damaged.

The longer that policymakers continue to inflict economic and capital market damage, the greater the risk that this year’s crash could endure longer and become more severe.

A severe decadal crash is emminently preventable.

A lifetime event is even more avoidable.

However, policymakers’ current trajectory and determination to pursue this course is a major market risk going forwards.

As we asked in our review of inflation,[6] “will the consequences of the attempts to fight the mythical inflation monster be more damaging than inflation itself?”

In most scenarios, we see attractive total return prospects in the next 1-3 years for long run treasuries.

For risk assets, such as equities, it continues to depend on just how much economic and earnings damage policymakers inflict. The more time (and further rate hikes) until we reach the pivot that seems to be increasingly seen as inevitable, the more we’ll see fragile assets damaged beyond repair and the more fragile we’ll see all risk assets become.

[3] https://www.morningstar.co.uk/uk/news/229548/worst-bond-market-ever.aspx

[4] 30-year treasuries reflected a total return of almost -35% in the 12 months to November

[5] https://www.suggestus.com/pci (as of 15th December)

The average MBMG IA US Dollar portfolio stands - 3.7% lower for the same period.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.