Dazed and confused.....

Why we're much more worried about America's policymakers.....

“I've been dazed and confused for so long it's not true” - Either Jimmy Page of Led Zeppelin or Joseph Robinette Biden Jr.

Paul appeared on yesterday’s edition of Street Signs with CNBC’s Will Koulouris. [1]

Part of the newer generation of financial journalists, Will brings some great contrarian thinking and insights from a background that includes a spell at Chinese State broadcast agency, Xinhua. This is allied to experience of private and proprietary trading.

Will Koulouris immediately focused on what Paul described as “the key questions that we're asking and everybody else is asking”, namely the effect of monetary and fiscal policy on economic and market outlook, especially in China, where recent data have disappointed markets, and in the USA, where long term interest rates have reversed their downward trajectory from last year’s peak:

US 30-year Treasury Constant Maturity Rate

Paul started by talking about why he remains comfortable with Chinese policymaker responses:-

“So far, they've been very graduated, very incremental and very controlled. When we compare PBoC [People’s Bank of China] policy to for instance the Fed [US Federal Reserve], the PBoC is like a high-performance luxury saloon car gradually accelerating away when the traffic lights turn green, with a sense of always being in control, whereas the Fed is more like a pimped-up boy racer, flooring it, pedal to the metal, completely out of control. We're more worried that the Fed is going to drive the US economy and markets off the road and crash and burn horribly. With the PBoC, we don't see any signs of alarm. In the West the big worry remains stagflation. In China we have the opposite. Growth may be weaker but there is positive economic growth while we also have negative CPI inflation. This has never been achieved before. If this continues, it could be a lesson to other policymakers how to operate policy in a sustainable way.”

Paul elaborated his recent view that market participants don’t really seem to understand this because they have become conditioned to reacting to immediate, grand gestures, such as the Federal Reserve injection of almost $1 trillion into the financial system that took place in just over a week in March this year. This was the steepest policy intervention in US history. Yet it seems to have been barely noticed and then largely forgotten (Will described it as ‘The bailout that nobody is allowed to mention’).

This focus by market participants means that graduated, controlled, responses, with slower impacts have resulted in data that have disappointed markets. In addition to negative consumer price inflation (i.e. ‘deflation’), recently released July data was weaker than forecast across areas such as retail sales and industrial output. Analysts were also disappointed that the level of investment into property fell. One further surprise was the announcement that official data will no longer break down jobless rate breakdowns by age.[2] This prompted negative inferences about youth unemployment in China. Youth unemployment in China reached record levels of 21.3% in June as overall unemployment crept up from 5.2% to 5.3%.

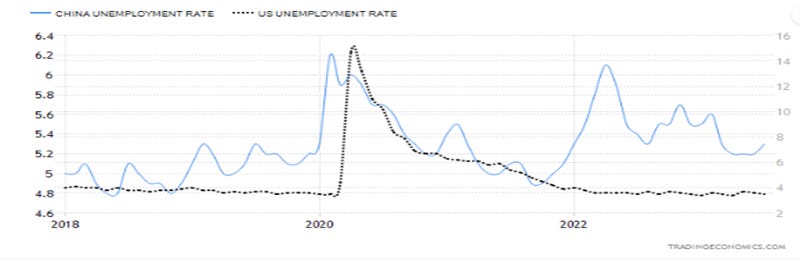

However, Paul believes that there are reasons to remain sanguine about this. Unemployment globally remains a very challenging metric to accurately measure or fully understand. The great lockdown of 2020 disrupted labour markets in ways that are still far from fully understood. Chinese unemployment data have historically been more volatile than US data:

However, this probably owes more to the different methodologies that are used to compile these data series. American data actually yield up 6 different unemployment rates (categorised as U1 to U6), based on 4 different categories of unemployment. [3] The U6 rate exhibits similar volatility (for methodological reasons) to the U3 rate shown in the preceding chart but at a much higher level of unemployment-

In fact, American U6 data for June came in at 5.3%, exactly the same rate as broader Chinese unemployment. It’s also worth noting that in 1970, labour compensation (i.e. salaries, wages and bonuses etc) made up 65% of the US economy, whereas less than 60% of Chinese national economic value was distributed to workers. Although the US share then fell (to an average level below 62.5%), it briefly spiked again to over 64% in 2001, while the Chinese workers’ share had fallen as low as 56% just a few years earlier. The most recent data that we have is for 2019, when US labour received 59.7% of national product while Chinese workers received 58.6%.

Of course, the US and Chinese economies are not comparable during this period. Chinese Gross National Income had grown from $100 billion in 1970 to $1.3 trillion in 2001 to $14.5 trillion in 2019. In comparison US GNI grew from $1.1 trillion to $10.5 trillion to $21.7 trillion over the same period. In other words, US GNI was almost 1000 times greater than Chinese GNI 53 years ago. It was 8 times greater 22 years ago and is around 1.4 times greater today.[4]

US President Biden, speaking at a political fund-raising event last week observed that China was “in trouble” and beset with ‘economic and social problems’. He then reeled off a series of wholly inaccurate and seemingly confected pseudo-statistics while adding

“That’s not good because when bad folks have problems, they do bad things, China is a ticking time bomb.”[5]

It’s well-known that President Biden has a tendency towards confusion.[6] It may be that he was in fact confusing America with China and the reference to “bad folks” makes most sense if we assume that it was in fact an autobiographical statement.

China appears to be suffering a ‘Great resignation’ similar to that in America. The difference is that US unemployment appears to have bottomed out in a way that in previous cycles preceded recession. Chinese unemployment still appears to be falling, in a way that is not indicative of impending recession.

Similarly, having obsessed about the high and rising levels of Consumer Price Inflation for the last 2-3 years, it seems bizarre that analysts are worried about Chinese CPI deflation. Last week’s edition of Boom Finance and Economics highlighted why this is a potentially positive development for China.[7] It also means that Chinese policymakers have plenty of available ‘fiscal space’ in which to inject stimulus into the economy and markets, gradually and incrementally. Again, we’d compare this to western policymakers having apparently crashed in the ditch yet again.

In particular, concerns about falling levels of property investment indicate a lack of understanding of Chinese policy goals.

China’s policymakers had ringside seats of the property bubbles in Japan, the UK and subsequently the US (not to mention Australia, New Zealand, Canada and Sweden) in recent decades. They seem determined to prevent housing reaching such levels of unaffordability that ultimately the sector crashes in a way that causes systemic risk. Inflicting pain on the real estate sector now is a form of prevention of a Chinese re-run of the US sub-prime crisis that was a major causal factor in the Global Financial Crisis of 2007-9, the aftermath of which still scars many economies today. Ensuring that property remains affordable, preventing property bubbles stretching to bursting point and reducing the risk of future systemic crises should all enhance long-term stability in China. However, capital markets have become accustomed to policymaker solutions that emphasise short-term support at the cost of longer-term stability. In such an environment, capital will immediately flow into the greater short-term opportunity. Our concern is that unless that short-term support continues indefinitely, capital will also find reasons to flow out again. This underpins our medium-term views that flight to safety assets (such as gold and treasuries) offer much more attractive medium-term risk-adjusted return opportunities than risk assets (such as equities and corporate bonds) and that traditional flight to safety currencies (such as Yen) look extremely attractive in the medium term, relative to USD. However, these opportunities may take some time to come to fruition and it may require patience and a willingness to accept short-term pain to fully reap this longer-term gain. The jury remains out on Chinese economic policymakers but the American people clearly deserve much better leadership. The system will almost certainly make sure that they don’t get it, whatever happens in US elections.

Paul’s discussions with Will Koulouris covered many other aspects of this but we’ll be back with further updates in the coming days that pick up on these.

[1] Here’s an excerpt that we will cover in more detail in the coming days.

[2] Previously it had split into age groups of 16-24, 25-59 and 60 and over.

[3] https://www.investopedia.com/ask/answers/063015/how-does-us-bureau-labor-statistics-calculate-unemployment-rate-published-monthly.asp gives a good, basic explanation of the methodologies used. Jeff Snider has been one of the more insightful long-term critics of reliance on the widely circulated but much less comprehensive U3 rate as opposed to the broadest U6 rate https://alhambrapartners.com/2018/06/01/the-unemployment-rate-is-useless-but-that-doesnt-mean-it-isnt-useful/ and https://alhambrapartners.com/2021/10/08/for-the-love-of-unemployment-rates/

[4] https://www.macrotrends.net/countries/CHN/china/gnp-gross-national-product and https://www.macrotrends.net/countries/USA/united-states/gnp-gross-national-product

[5] https://www.aljazeera.com/news/2023/8/12/bidens-ticking-time-bomb-remark-referred-to-chinas-economy-white-house

https://people.com/president-joe-biden-causes-confusion-after-saying-god-save-the-queen-7548852 https://www.foxnews.com/politics/biden-confuses-ukraine-russia-zelenskyy-putin-gaffe-filled-trip-lithuania

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.