Inflation is running at the highest levels seen in decades.

Interest rates are also headed to the highest levels in many years.

How worried should we all be about inflation? Or the impact of higher borrowing costs? Or economic slowdown? Or so called 'stagflation' (the nightmare scenario of both slower growth and higher inflation)?

Myself and the team at MBMG Group take a deep dive into these issues in this video https://www.youtube.com/watch?v=P8hOIuo3q0o and discover some very uncomfortable indicators, mainly using research and data provided by the Federal Reserve Bank itself (FRED).

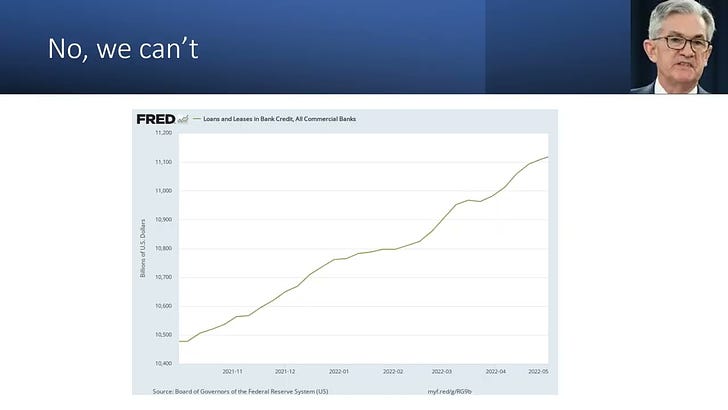

Not only have savings have been exhausted but corporate and personal debt are on the rise, in a way that indicates that the US economy is slowing far more than policymakers intended right now, that the quality of borrowing indicates serious underlying economic concerns and that a wave of defaults may be coming unless policymakers change path urgently.

<iframe width="560" height="315" src="

title="YouTube video player" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>

Thanks for reading MBMG Flash! Subscribe for free to receive new posts and support my work.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

Do you have any questions? Do not hesitate to contact me directly by email: Paul@mbmg-investment.com

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.