Electile dysfunction

Hopelessly de-voted? (MBMG IA Client Note, 1st November 2022)

[Since this note was written, the FOMC meeting confirmed an increase in Federal Funds rate of 0.75% and also confirmed that it does have totally unwarranted faith in its own ability to pull the levers that control the US economy, rather like the Wizard behind the curtain in Oz and stories have emerged of evidence of the UK’s involvement in acts of state terror or war against the largest country on the planet].

Last month, we once again considered the continuing theme of the determination of policymakers to inflict significant pain on investors and lasting damage on the economy.

In a significant change of tone in October, policymakers indicated a softening in this approach – instead of beheading the economy and the markets with continued egregiously excessive rate increases, the markets have inferred that the Fed will instead simply mortally wound it instead with moderately excessive rate increases (75 Basis points in November and 50 Basis Points from December onwards). This follows similar sentiments from other central banks, such as the Bank of Canada which last week already moved to 50 BPs hikes.

This may be significant-

1. It underlines the idea that policymakers have, since the GFC become wedded to the idea that they can calibrate the performance of economies (and capital markets) by turning liquidity taps off and on with infinite precision.[1] In other words, it increases expectations that we will simply continue with more of the same – see the QEQT infinite diagram on the following page. It’s as if policymakers believe that they have created a friction-free version of Newton’s Cradle[2], that can continue in perpetuity, despite the evidence that each injection of energy, in the form of QE is significantly greater than the one required previously. However, that appears to be the direction of travel, so all that any of us can do is perhaps to acknowledge it and act accordingly. In 2016, I remember animated discussions with the excellent CNBC anchors Martin Soong and Oriel Morrison, who were both quicker than I had been to recognise these patterns of Fed behaviour.

MBMG representation of increasing QE required each time-

Sir Isaac Newton’s Balls

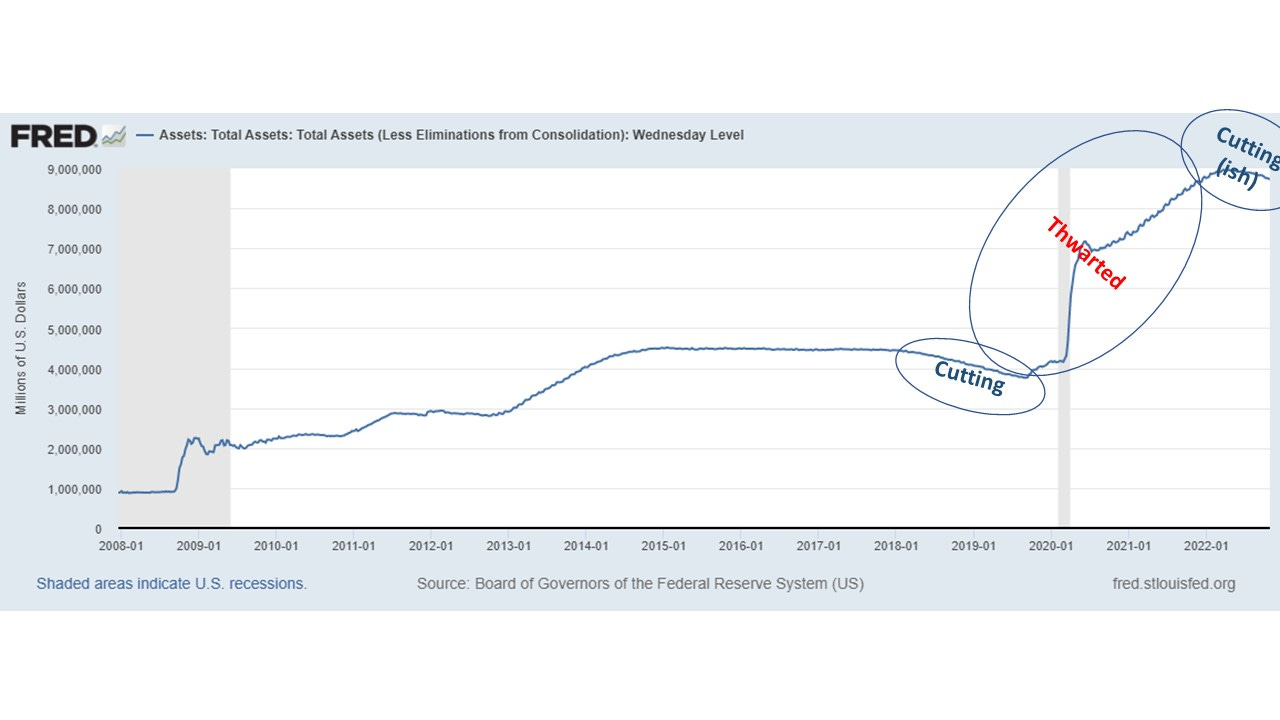

2. Policymakers were determined to hike rates and shrink balance sheets heading into 2020 – they were thwarted by the COVID lockdown induced economic and capital market headwinds. Instead, they were forced to cut rates and double balance sheets – since then, the returned with a vengeance, although most actions so far have been directed at short term interest rates, with minimal impact on asset holdings (i.e. the size of the Fed balance sheet):

It remains to be seen how many more rate hikes and asset sales they will be able to execute. However, the lack of liquidity from markets such as treasuries and mortgage backed securities – which have driven mortgage spreads to record highs - is already damaging housing markets, equity markets and even cryptos. Their usual response to problems is to simply buckle. [3]

2. However, it seems that there is also an increasing chance that policymakers may act before they irreparably damage economies and capital markets. The speed with which they ‘pivot’ from here to rate cuts and asset purchases and the scale of the cuts and the balance sheet run-up will be the primary factor that determines asset values in 2023 – currently, it only seems to be the weakest parts of the system (UK pensions and European mega-banks) that are feeling the strain and so feet could be held to flames for longer than the October equity bounce suggests but not for long enough to do mortal damage to equity or property markets. However, that relies on the skill and competence of policymakers who seem to believe in their own ability to defy basic laws of nature, so it’s certainly not a slam dunk either, especially as policymakers have disingenuously tied their actions to the persistent inflation caused by the geopolitical policies of colleagues or associates.

We also have to remember that the US mid-term elections could be disruptive, and that if reports of NATO involvement in the attack on the Nord Stream pipeline and attacks on Russian Black Sea military assets are to be believed, then these powers have attacked Russian installations in Russian territory for the first time since World War I (or at least its aftermath).

This remains a period of extreme uncertainty – much of which was not reflected in the recent rebounds in risk assets.

On balance, we now expect to see a more constructive approach to monetary policy gradually emerge during 2023, but there’s no certainty that this will succeed or even happen in time.

For some time, we’ve said that the price and traded volume of cryptos could be the canary in the liquidity coalmine – they’re certainly one of the indicators that we’re watching for either capitulation or sustained rebound. In a world run by illogical actors, we might best be able to anticipate upcoming plot twists from the behaviour of illogical pseudo-assets.

Was it ever settled? Was it ever over? And is it still raining, back in November?

– Did I ever Love you? - Leonard Cohen

[1] I’m aware of the impossibility of infinite precision in nature and in arithmetic – policymakers seem to have faith in their own superpowers to overcome such obstacles https://medium.com/intuitionmachine/the-delusion-of-infinite-precision-numbers-add501a1518d

[2] Newton's cradle is a device that demonstrates the conservation of momentum and the conservation of energy with swinging spheres. When one sphere at the end is lifted and released, it strikes the stationary spheres, transmitting a force through the stationary spheres that pushes the last sphere upward. The last sphere swings back and strikes the nearly stationary spheres, repeating the effect in the opposite direction. The device is named after 17th-century English scientist Sir Isaac Newton and designed by French scientist Edme Mariotte. It is also known as Newton's pendulum, Newton's balls, Newton's rocker or executive ball clicker”-https://en.wikipedia.org/wiki/Newton%27s_cradle

[3] We have also created a presentation which can be viewed at

Paul Gambles Managing Partner , MBMG Group

Paul’s range of expertise includes asset allocation, tax structuring and macro-economic analysis. He graduated Cum Laude from the University of Warwick, B.A. in English and European Literature, and became a Full Technical Inspector at the UK Inland Revenue. He then moved to the Bank of Scotland Group and spent nine years in corporate and asset finance. In 1994 he helped set up MBMG Group. Paul has completed CFA Level 1 and he is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner. He is well known as an expert commentator appearing regularly on CNBC, Bloomberg TV and Channel News Asia. Paul is a regular contributor to industry and chamber of commerce magazines.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with an advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum.