Fedhex...Powell channels inner Shari Lewis

Policymakers create problems for markets, markets create problems for policymakers...

Paul was asked by Bloomberg’s Doug Krizner this week about his recent comments about fighting the Fed being both a bad idea and something of an impossibility in view of the difficulty in actually tying down the Fed’s position as it swings so dramatically from the greatest stimuli project ever seen during the pandemic lockdowns to the fastest monetary tightening in history and is now being hotly anticipated to revert to further easing.

Paul congratulated Doug on an excellent summary before adding “Our problem here is that the Fed works under its own internal logic. Objectively they made policy mistakes over the last couple of years, which led to the creation of inflation because of the timing, as much as anything else, of the policies that they implemented.

The people who made those mistakes, who got that timing wrong, are now trying to clean up the mess that they made but they still appear to be using the same framework. So, the real worry is that they still have no idea how to get the timing right. They got the sequencing wrong on the way into this and we don't think they've got any idea how to get the timing right on the way out. Certainly they seem to be still addressing policy by, by driving by looking through the rearview mirror.”

The main Fed policy tool…

“Hence, our conclusion, you can't fight the Fed because you're not likely to win that although the problem is actually knowing exactly where the Fed stands because the Fed has been very slippery going from excessively easy to extremely tight,. Also along that journey, the one thing about the Fed is that they are consistently inconsistent. The messages that keep coming out from them all the time don't help us to build a clear picture of what the Fed will do.”

Doug asked Paul whether the Fed’s efforts to coordinate messaging and present a united front the previous day, Valentine’s Day in fact, had been either helpful or successful/

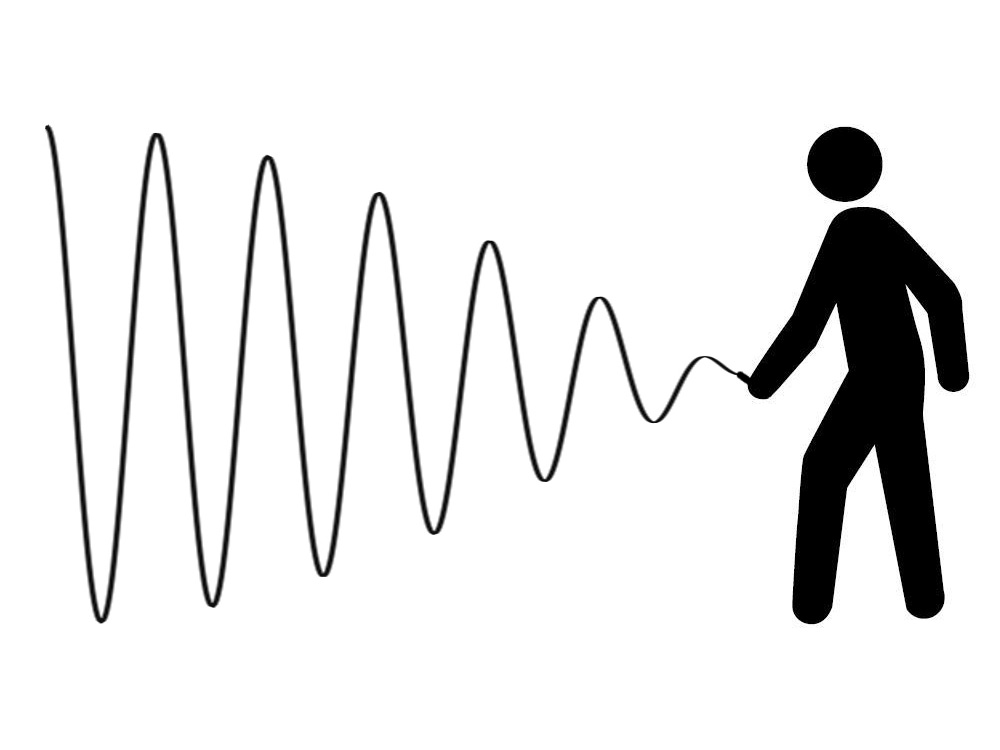

Paul replied that attempts amongst Fed officials to coordinate messaging aren’t always particularly successful “The Fed are highly reactive. Data emerge and in response everybody from the Fed is sent out to go and put out a new version of the message. One thing that we think they're ignoring, and therefore they're exacerbating, is this idea which has been the subject of some fantastic work on Bloomberg, on Odd Lots by Tracy Alloway and Joe Weisenthal about how the functioning of the real economy post reopening, how we've got this kind of cyclicality, these supply and demand bullwhip Forrester waves[1] because of the nature of reopening, which we think are now feeding through to inflation, and to interest rates and we think it's feeding through to Fed policy responses. We expect to continue getting data that are alternately, more inflationary than people expect, and less inflationary than people expect because of this wave or bullwhip effect which is just not being factored into Fed thinking, something which markets have also been guilty of.”

By Gusts_Must_be_Ambulatory.JPG: ThwongterryAmplitude_modulation.svg

Doug noted that markets, because of their property as a giant discounting machine, are probably more grounded in truth and reality than the Fed. Doug acknowledged that Paul had historically succeeded in outperforming and outsmarting markets in the past but wondered whether the market or the Fed had the better take on realities right now.

Paul made the distinction that “We might try to outsmart the market rather than trying to outsmart the Fed, especially when we think that the market is getting ahead of itself relative to the Fed, which is what creates opportunities . Certainly in January it seemed to us that the market was racing way ahead in assuming that the Fed was going to be suddenly become a lot more dovish. This was possible, but there really weren't any solid reasons to expect that.

So you've got to look at times for the market getting out of step, rather than trying to fight the Fed. I essence, that's what the market seemed to be doing in January, by taking such a bullish approach, in assuming that we'd see a much softer interest rate policy much sooner from the Fed.”

Doug’s colleague, Michelle Jamrisko, then raised the question as to whether Fed unanimity was dangerous – that rallying around a single ‘party line’ created rather than reduced risk?

Paul acknowledged thus ‘fantastic point ‘ adding “I have no idea what Fed officials actually believe and I'm not sure they do either, but in this bullwhip environment where we're going to keep getting waves of higher inflation, lower inflation, higher activity, lower activity, higher growth, lower growth, when we're going to keep getting those waves time after time, one thing that you want is a little bit of skepticism or a bit of balance.”

A recent meeting of the Federal Open Market Committee

“You want dissenting voices because that helps to smooth the path. What we have got is a Fed that is, as you say, relatively unanimous; it keeps running from like one side of the boat over to the other and then back again, taking views and then opposing positions very fervently.”

Paul concluded by explaining the investment strategy implications of this bullwhip or Forrester wave effect.

“There are two approaches that you could adopt right now: you could try and get it right and go all in on what you think the Fed is going to do and what the consequences of that is going to be. If you get that right, you're going to be a hero but that is it's very difficult, almost impossible, to get right with any certainty. And if you get it wrong, then you, you really are going to be a zero. So, we think you've got to look at the different ways that this strategy can play out, and you've got to look at different solutions that are going to work in different environments.

[1] The so-called bullwhip-effect describes the supply/demand phenomenon in which the variability in orders to suppliers exceeds the actual variability in sales, creating supply chain volatility and issues such as bottlenecks, potentially causing inventory volatility, shortages and period inflation. First cited by Jay Forrester, it is also known as the Forrester effect.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.