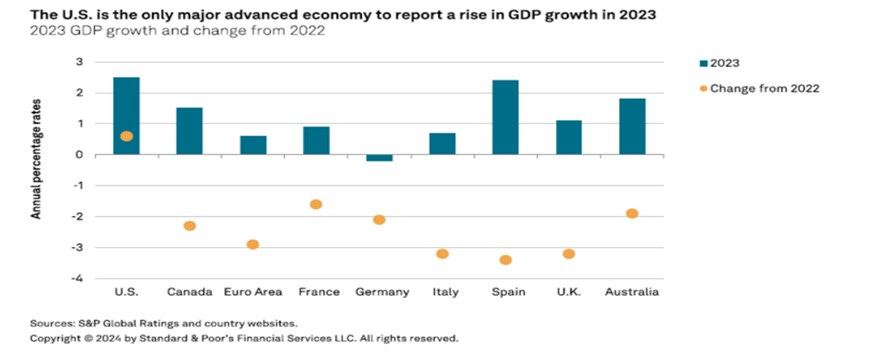

Actually, they don’t. The global economy excluding America has been slowing towards stall speed for some time:

This begs the following questions:

· So why is there any need to worry about the US economy?

And

· Why is America doing so much better than other major economies?

And

· Why are have American equity markets been booming?

Let’s take the last question first - much of this is down to the questionable assumptions that policymakers have markets’ backs, can manage the economy and that a managed slowing is a good thing, largely because it implies sustained reductions in both inflation and interest rates and therefore more favourable discount rates and increased corporate profits (even though elevated rates have helped boost corporate profit margins to 70 years highs). Wall Street Kool-aid encourages sell-side analysts to spout far more than six impossible things before breakfast every day and buy side analysts, like some super-medicated Queen of Hearts to believe them all, especially if they include the term ‘AI’.

In terms of concerns about the US economy, a deteriorating employment situation, resulting in weaker consumption indicates an extremely high risk of the US economy slowing to the point of contraction (recession) is now starting to materialise. This should be no surprise as financial conditions have been tightening since the second half of 2022:

American policymakers created inflation in the real economy through heavy-handed stimulus policies, while also subscribing to their long-term mission of boosting asset price inflation. So far, they have managed to gradually rein back economic impetus, while maintaining supportive conditions for assets.

However, this is only part of the picture. Leaving aside the value extractive policies of US financial imperialism which ramped to a whole new level when Europe volunteered to bear the main downsides of Biden’s military campaigns against Russia, we have long explained that the real difference between US policy and that of other major economies is just how accommodatory US fiscal policy (including the blurred lines between fiscal and monetary) and how tight US monetary policy has been (American policymakers have been increasing the volume of money but also increasing the price [interest rates and to some extent exchange rates] of that money). This has resulted in exceptional levels of capital market liquidity that have supported and propelled investment asset prices, but limited the distribution of income throughout the economy. No other advanced economy has come close to such easy fiscal policy:

We explained in our May Outlook the contradictions of easy US fiscal policy overlaid on tight monetary policy and the consequences of these contradictions:

Tight monetary policy + loose fiscal policy ≠ neutral policy

“Policymakers seem to have long past the point where reliance on excess liquidity will be able to mask the effects of overly tight monetary policy at some point in the future. This almost certainly means economic slowdown and a sharp fall in the value of risk assets, despite interest rate cuts.

At that point, we expect the most active and powerful policymakers (The Fed/Treasury) to resort to measures to once again ‘bail out’ the economy and the markets from the mess that policymakers have inflicted.

We expect the more hamstrung policymakers (The ECB/EZ governments) to lag,

and we expect the more competent policymakers (the PBoC, MoF and NDRC) to watch these machinations with a degree of puzzlement and contempt.

[For some time now] US policy has driven asset prices much higher and has stepped in aggressively to place a floor under any setbacks,

Eurozone policy has been a weaker, slower version of the same and

Chinese policy has generally tended to simply disregard short-term risk asset performance [focusing on the twin aims of longer-term sustainable growth with short-term palliatives to avoid only extreme problems – capital marketism with Chinese characteristics]”

MBMG Outlook May, 2024

Getting fooled again (& again & again….)

Markets, on the other hand, have happily bought into the twin delusions that policymakers have their backs and know what they’re doing –

Bank of America’s Global Fund Manager Survey (https://business.bofa.com/en-us/content/global-research-about.html), which tracks the sentiment of approximately 300 institutional, mutual and hedge fund managers around the world each month, indicated that only 7% of respondents expected a hard-landing/slowdown/recession. This was down from 30% who had expected such an outcome in Q4 2023, even though the evidence of slowdown has become more evident during that time.

As we wrote in May, “The main problem with the soft/hard/no landing debate, other than most respondents calling it wrong, is that it also disregards the 4th possibility, which is also one of the two most probable outcomes IMO, namely stagflation.

Ending Bretton Woods/the gold standard gave policymakers new challenges and new toolkits They fluffed their lines. Lockdown and direct stimmies gave policymakers more new challenges and new toolkits. They fluffed their lines again.”

Is there any good news for readers who have persevered with this marathon moan so far? Yes. The end is in sight - both for this phase of policy mismanagement (although the denouement won’t be pretty and the aftermath will almost certainly be an even greater scale of policy mismanagement and also for this particular serialisation. Thanks for your patience.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum.