Inability to sustain an election

Democracy - the art and science of running the circus from the monkey-cage – HL Mencken

As the date of the election looms ever closer, a terrible outcome now seems inevitable. Having studied the latest polling data and betting trends, we believe that it is now almost certain that the next President of the USA will be Kamala Harris……….... or Donald Trump (henceforth collectively referred to as President Harrump).

“The United States is also a one-party state but, with typical American extravagance, they have two of them.” – Julius Nyere

One of the better macro commentators followed by MBMG recently made the following observations[1]:

1. All that clients want to talk about is US elections.

2. They feel this will be the most important election of our lifetime.

3. The one clear common theme about Kamala and Trump is fiscal deficits.

The commentary used the chart below to highlight the 6-month rolling changes in 30-year US Treasury yields and the 6-month DXY (US Dollar Index) rolling returns around each US election since 1984:

The commentary draws 3 key conclusions from the chart:

Elections rarely deliver huge market moves

Macro context matters a great deal (USD cross rates and US treasury yields are mainly impacted by a host of macro factors outside the election echo chamber.)

Ignore anyone saying, ‘The Bond Vigilantes[2] are coming’ (there has been no period of rejection of US assets, where bond yields have risen, and bond prices therefore fallen, while the currency has softened at the same time – the bottom/right-hand half of the pink box).

In other words, the recent spike in long-term yields is a gut reaction to increased expectations of a Trump win but, even if that outcome does prevail, then this is an ephemeral knee-jerk and should be really seen as a buying opportunity in long-term treasuries, especially zero coupons, or as the commentary concludes “yes: markets are already preparing for a Trump win with a sell-off in rates. But that does not mean ‘The Bond Vigilantes are coming’ ’’.

We’ll come back to another aspect of the commentary to take a look at the risk and outlook for equities but first, let’s consider the implications of this observation that markets are currently pricing on ‘bond vigilantism’ which has absolutely no basis in empirical fact. The linked ideas that US rates will be driven higher by deficits and that the long-term US fiscal position is somehow made precarious by these higher deficits maybe can’t quite be dismissed as absolute nonsense but as investment advice it ranks approximately alongside the belief in the wealth effect of carrying a rabbit’s foot or knocking on wood or here in Ireland the belief that if your left palm is itchy, then you’re about to come into money.

In The Deficit Myth, Professor Stephanie Kelton does an excellent job of explaining just how and why treasury instruments are just interest-bearing units of currency. This has been largely ignored by a mainstream investment and economics community that instead clings to archaic articles of faith about monetary economics that have been repeatedly empirically disproven in the last half a century or more.

It’s important to understand that any increase in economic or financial activity each requires additional funding and that as the Bank of England[3] has pointed out, new currency creation comes either from banks in the form of lending or governments in the form of money creation (issuing coins and notes or issuing treasury instruments).

Therefore, any increase in economic activity or financial activity that is not derived from governmental money creation is derived from increases in private sector borrowing, whether by businesses or consumers, who, unlike governments who issue currency, ultimately have to pay this back.

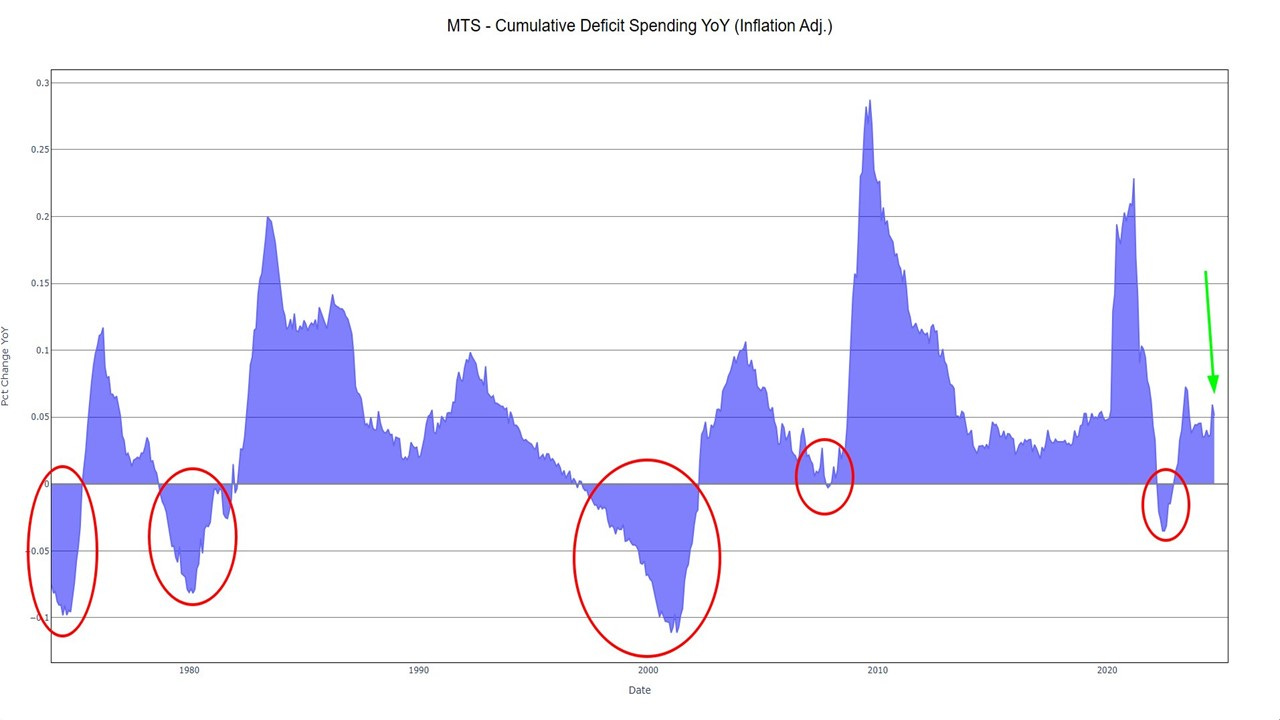

This imposes a limitation on private borrowing which in turn creates a cycle of private borrowing and repayment that is inherently volatile and has been the key factor in both booms and busts in the modern global economy. [4] Professor Kelton’s detailed explanation of the mechanics of sovereign currencies and of monetary policy, is supported by empirical evidence cited by Douglas Padgett of Applied MMT Trader, who observes that “the worst market crashes & recession have all occurred following government surpluses while strong deficits have all preceded the strongest bull runs in history”:-

The idea that Trump or Harris will somehow break the US bond market for the next 30 years by excessive fiscal largesse is an utter red herring, whereas the question that should be asked is for how much longer, would either be capable of directing sufficient largesse to support economic activity and also US equity markets

Money creation typically flows into economic activity (trade, commerce, consumption) or financial activity (capital markets).

Increase in such activity typically requires not only continued inflows but an acceleration in these flows.

Bubbles are created when these flows accelerate unsustainably. Crashes happen when the unsustainable can no longer sustain.

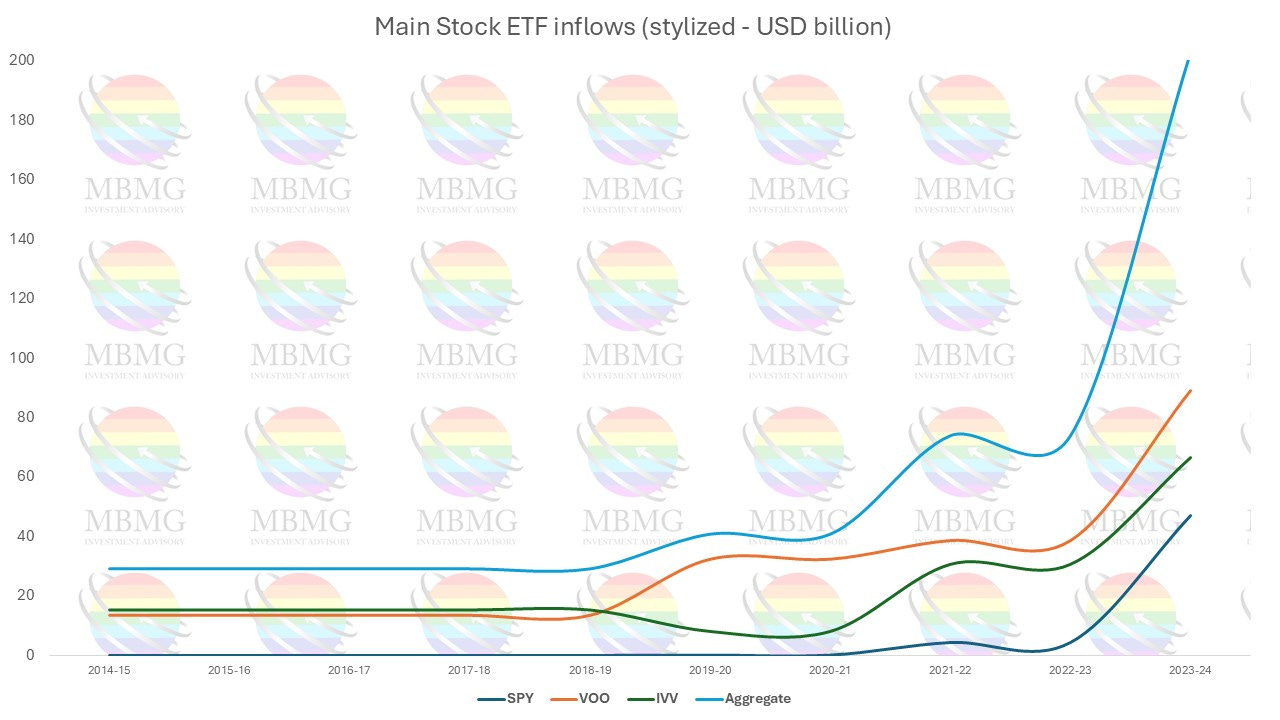

The following chart shows the inflows each year (to October) into the main US equity exchange traded funds, adjusted to minimise annual volatility and highlight longer-term trends:

For the five years ended October 2019, aggregate inflows into the 3 biggest S&P500 ETFs averaged just under US$ 30 billion per year and the S&P 500 grew at just under 11% per year. Over the next 4 years, the inflows increased and the rolling multi-year average S&P500 return ticked higher.

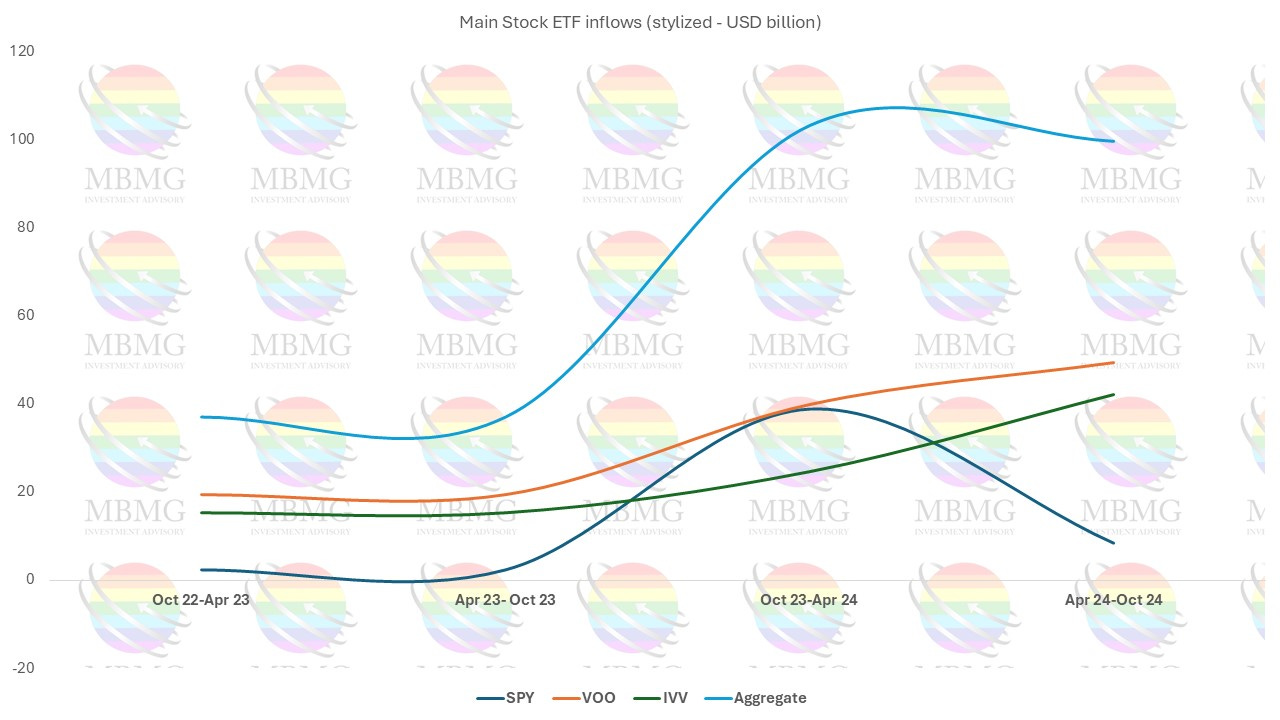

Over the last year or so, inflows exploded exponentially (to over $200 billion) and S&P 500 returns have also rocketed. The additional money created in the US economy has flowed disproportionately into equity markets. Breaking this down into semi-annual periods, this occurred primarily in the 18-month period from April last year:

In the 12 months to the beginning of April this year, the S&P500 increased by around 25%. In the subsequent 6 months, it has added roughly another 12%. And while the inflows in the last 6 months have been a whopping US$100 billion, that’s slightly lower than the previous 6 months. In mother months, inflows may be struggling under the weight of gravity to continue to increase from these gargantuan levels. Stock prices have been increasingly volatile as further progress in the current environment looks increasingly challenging (S&P500 Index, last 6 months):

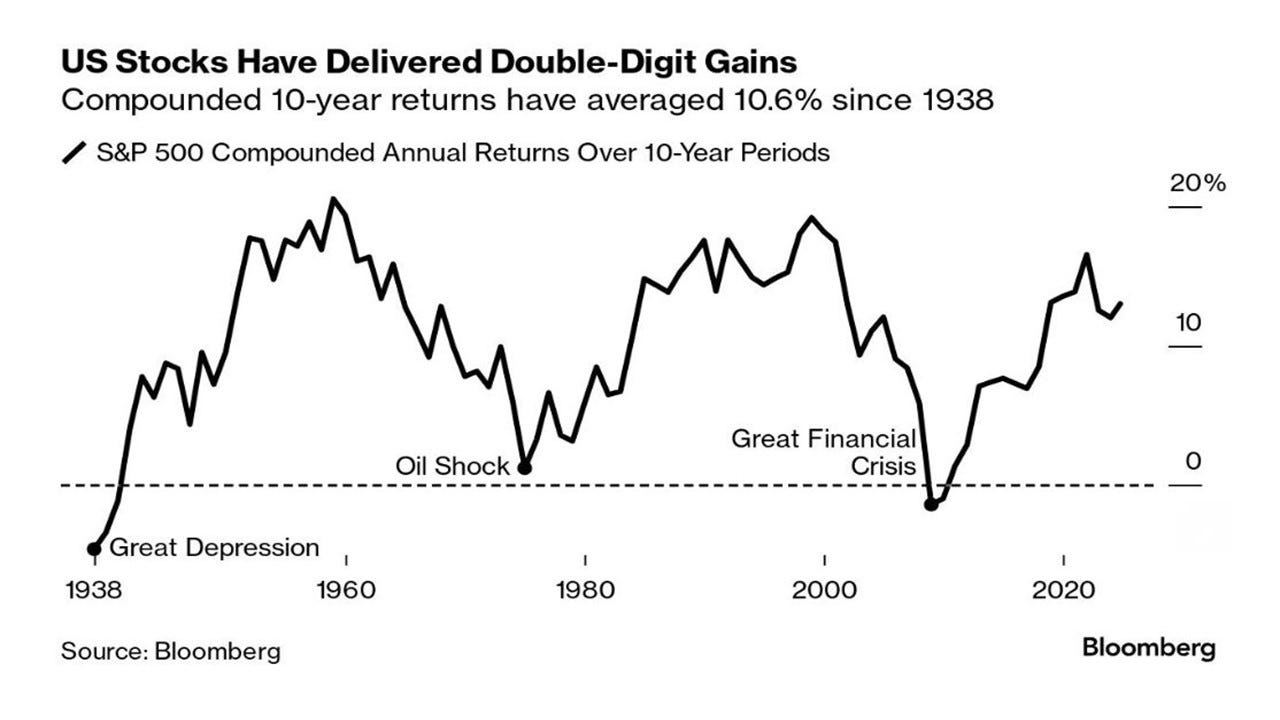

America’s new POTUS, whichever monkey is chosen to run the circus, may not be able to provide sufficient fiscal input to maintain flows conducive to higher equity prices going forwards. This may explain some of the concern expressed by Goldman Sachs investment strategist David Kostin and his team, who expect a cyclical de-rating and mean reversion of equity performance as investors turn to other assets including bonds for better returns. They expect the S&P 500 to post an annualized nominal total return of just 3% over the next decade, compared with 13% in the last decade, and a long-term average of 11%. They also see a 72% probability that it will underperform treasuries and even one in three chance that in real terms (i.e. adjusted for inflation) stocks will lose money for the next 10 years as the current period of outperformance ends (as have similar periods in the past):

Returning to the macro commentary that we began this update with, when we equated bond vigilantes with bogey men – scary but not real. The commentary provides an added glimmer of hope for equities in the event of a Trump victory:

“By the end of 2025, the 2017 Trump tax cuts are set to expire. Trump pledged to reduce them even further (from 21% to 15%), while Kamala wants an increase to 27%.

The table below shows the EPS impact on various sectors of the US stock market:

We harbour doubts about the ability of Trump to force through consensual tax cuts (but since when did Trump care about consent?) when the US Congress and Senate share the market’s misconceptions about the national budget (which may in this case be neutralised by the fact that they also have no idea of limitations of pros and the full danger of the cons relating to tax cuts).[5] Therefore, we favour increased adoption of protected strategies to equity investing.

Actually, we harbour doubts about the ability of Trump in general (except when it comes to lining the pockets of D J Trump or the Trump Organization).

We also harbour doubts about Harris in general (except when it comes to enabling genocide or provoking military conflict).

This election strikes us as just the latest iteration of what we term Potemkin democracy.[6]

In that sense, it is a continuation of the last half century or more of elections that has seen the deterioration of popular influence in western politics.

It seems unlikely that either Trump or Harris can break the US bond market and even more unlikely that even if they could, that they would be allowed to do so.

It seems a more pertinent question as to whether either of them can prevent a looming US recession or stockmarket crash.

It seems unlikely to us that President Trump 2.0 would be any improvement on all the failings of Trump’s first, grim tenure.

It’s not clear to us how Harris would improve on or even match the performance of the administration for which she was VP, whose most notable achievements were to provoke the first land war in Europe for almost 80 years, to destabilise the Middle East, to repeatedly aim to provoke conflict in the Taiwan Straits and to enable genocide on every continent.

A second Trump presidency is a deeply unpleasant prospect, and probably the most threatening for the failing American domestic status quo.

A Harris presidency is a death sentence for millions and potentially billions of innocents globally.

The interests who control America have a pretty non-existent track record of ever having ‘taken one for the team’ so are probably more focused on the ongoing, continued exploitation of the 341,814,000[7] than on doing the right thing.

In those contexts, the survival of the US bond market is an extremely limited comfort.

A Trump victory is more personally distasteful but better for global security and may in some way increase the chances of mass repudiation of the current socio-economic framework but whichever Jekyll or Hyde candidate wins, neither seems sufficiently powerful to break the US bond market nor to be able to significantly further inflate US equity bubbles. To us, William Henry Harrison remains the high watermark of US presidencies. [8]

[1] The Macro Compass by Alfonso Peccatiello

[2] As far as I recall, the term ‘Bond Vigilante entered popular usage during the Clinton administration era, following an episode when in just over a year from October 1993 US benchmark 10-year treasury yields climbed from 5.2% to just over 8.0%, due to market concerns of increased US governmental spending. This episode became known, somewhat melodramatically, as ‘The Great Bond Market Massacre’. The Clinton Administration adopted less ambitious spending plans, which resulted bond yields falling below 4% in response to the first balanced budget for almost 30 years and ultimately a Federal surplus (the corresponding private sector deficit being a major contributor to the explosion of corporate and then household debt, which were causal factors in the Tech Wreck of 2000-2002 and the Global Financial Crisis or ‘GFC’ of 2007-2009). Clinton political advisor James Carville, famously stated at the time- “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody." However, the evidence of the Clinton era and subsequent attempts for Bond Vigilantes to reappear, other than as the title to an excellent blog by the fixed interest team at M&G, is that markets generally misunderstand the impact of federal budgets and these episodes actually represent buying opportunities. One example cited is the market’s attempts to drive up rates and drive down the USD value during the Obama administration period. However, the USD in fact appreciated by 10% as the US economy recovered strongly from the GFC.

[3] https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy

[4] Housing sector overleverage was a key factor in causing the Global Financial Crisis whereas rapid overextension of corporate leverage in the technology and internet space was a major driver of the ‘Tech Wreck’ at the turn of the millennium.

[5] We use the term pro and con in every sense of each word.

[6] In our view, which owes a great deal to thought leadership such as Noam Chomsky’s Necessary Illusions: Thought Control in Democratic Societies and Failed States: The Abuse of Power and the Assault on Democracy, western democracy is a form of stylised theatrical performance whose only purpose is to perpetuate systems of government which are designed to give the impression of allowing citizens to broadly participate in influencing governmental policies while in fact concentrating ever more control and power in the hands of an ever smaller elite, whose aims are served by carefully groomed media, intellectual and political professionals.

[7] Latest census data indicate the population of the USA to be 341,814,420.

[8] Harrison died 3 weeks after his inauguration deliriously delivering these final words to his physician "Sir, I wish you to understand the true principles of the government. I wish them carried out. I ask nothing more." It is now believed that Harrison was poisoned by life at the White House, specifically its sewage-infected water supply.