A recent chat with CNBC’s Squawk Box Europe desk in London covered many of the key issues that dominate our thinking right now. Here is a link to rewatch an extract of the wide-ranging discussion

https://www.cnbc.com/video/2022/03/22/investment-firm-terrified-by-fed-hikes-overlooks-structural-issues.html

We’ve summarized the conversation and key points below.

CNBC’s Steve Sedgwick-

Good morning, my friend. You and I have had some great conversations over the years about your concerns of precipitous declines in the stock market, but that was before a war in Europe and before concerns about raging energy prices. I presume now you're even more bearish about equities.

MBMG’s Paul Gambles-

Good morning, Steve. I guess we’re mildly more bearish, but the real structural problems have nothing to do with the conflict that's happening now - They've been coming for an awful long time. We've been talking about them as they've gradually evolved and grown. Obviously, it's a scary situation that we're in but I don't think it's an exponential ramping up of the problems. It's just somebody shining a light and focusing on the problems that have been building for years.

CNBC’s Steve Sedgwick-

We've had a huge degree of calm come back but do you believe that the rallies are in a declining market?

MBMG’s Paul Gambles-

We all know that nothing bounces better than a dead cat and the real problem here is that none of the structural problems have actually been addressed. We've gone from a situation where people became suddenly aware of all the problems that have been there for some time. I think the reason why markets are rallying is because people weren't frightened by what the Fed said, but the reason that we think that the problems haven't really gone away is that we were terrified by what the Fed said.

CNBC’s Karen Tso-

Paul, I'm hearing a fairly hawkish tone from you, really considering the circumstances. We learned that Ukraine is something the Fed are not taking into consideration in terms of its impact on growth, but more in terms of its impact on further fuelling inflation. If you consider some of the language that we've heard about a 50-basis point rate hike and the trajectory that every meeting is a live meeting [i.e. that the Fed may raise interest rates at each of its 6 remaining meetings in 2022], doesn't it make sense for the Fed to, to really move more on interest rates earlier and then perhaps just pull back a little bit later on given there is a lag between such a blunt in instrument being used?

MBMG’s Paul Gambles-

We saw the interventions in 2018. We saw that the problems that these caused [The Fed raised interest rates, increasing the Federal Funds Rate from just over 0.1% in 2015 to a peak of around 2.4% at the end of 2018, before then cutting them to zero just over a year later] and the damage that caused, but that was into a much healthier economy and much healthier market than the one that they are hiking into right now. Hiking into this kind of fragility, it's very hard to imagine that they're just reach a point at which they can say “okay the supply shock inflation has gone away because we've destroyed so much demand. Now let's just turn the demand back on again and everything is going to be fine.”

I just can't imagine how everything will turn out fine in that scenario.

CNBC’s Karen Tso-

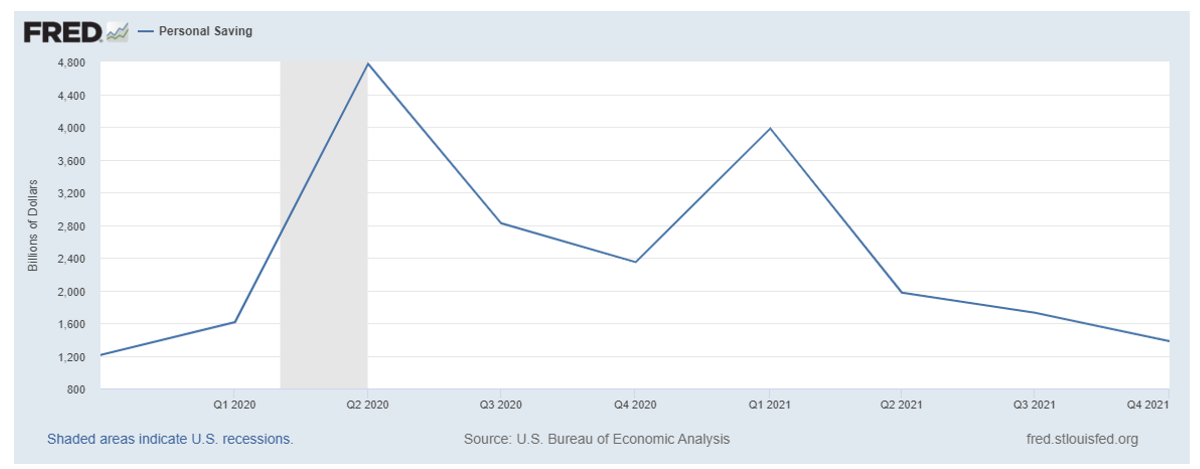

Can I just ask you a little bit more about demand then? Already we’re seeing US consumer confidence just starting to slide away from higher levels - does this tell us something about Main Street and how Main Street is feeling about the pressures that they're facing every time consumers go to the pump, every time they go to the supermarket and beyond that they are facing those elevated costs and perhaps they've already dwindled or used some of those excess savings at this point in contrast to Wall Street, which continues to push the stock market higher? [Personal savings were given a huge boost in the US during the pandemic, largely due to a combination of stimulus payments and reduced spending. However, these savings have now largely dissipated, especially from consumers with the greatest propensity to spend additional savings:

MBMG’s Paul Gambles-

Exactly. I think that's real dichotomy. It's been the dichotomy for a number of years and it's just becoming more and more apparent in terms of real measures of demand. For instance, oil consumption isn't going to be higher, certainly not significantly higher than pre COVID. [Global oil consumption averaged just below 100 million barrels per day in 2019, this fell to around 91 million barrels in 2020 and an estimated 96 million barrels in 2021 and has been forecasted to finally move above 100 million barrels per day in 2022, although there is now considerable doubt about this.]

This is not a demand issue.

Similarly, everybody was talking about timber prices last year and the previous year but whenever we get a spike in timber prices now, and in other supply-disrupted commodities, that spike is lower than the previous spike, which is telling us that inflation is coming down of its own accord. It's taking longer, but supply shock inflation is coming down of its own accord, so cratering the demand side is not going to help that. It's not help people at the gas pumps. It's really just going to leave a different, huge problem behind when the people at the gas pumps don't have jobs and don't have the income to, to pay for gas. That's when it's suddenly going to turn really ugly. I don't believe that the Fed is nimble enough to be able to pirouette on a dime and suddenly turn all the taps back on again.

CNBC’s Julianna Tatelbaum

Paul how are you thinking about the outlook for China and its impact on the global economy. I just saw that Goldman Sachs is now saying that COVID restrictions in China could take a point off growth in 2022. What's your take?

MBMG’s Paul Gambles-

There's a huge number of challenges still in China. We are still relatively bullish on China because we still expect the kind of policy accommodation in China that we also think the west needs to do in these circumstances, but the west is doing the opposite. So, we think there's going to be a real divergence in policy and that divergence in policy is going to lead to a divergence in economic output and therefore to a divergence in financial market performance too.

CNBC’s Julianna Tatelbaum

I saw that like, uh, many investors, you have upped your cash holdings in recent weeks or months. Do you really want to be invested in cash right now? I mean, is the opportunity cost low enough that you can justify that ?

MBMG’s Paul Gambles-

We don't ever want to be invested in cash if there's anything better to invest in, but it's always the starting point and if there is nothing better than then you hold cash. Our clients’ cash holdings likely got much higher last week because we advised that they exited from a lot of holdings such as gold miners, uranium, some of the oil companies and natural gas. So, while we don't want to hold cash, it's de facto that when you sell things that have gone up too far, too fast, and there's nothing else to fully redeploy the proceeds into, then you end up holding cash.

For any more background on these points or to ask us any questions that the typically thorough Squawk Box Europe team might have overlooked, don’t hesitate to drop us a line.

These discussion points also form the basis of our Quarter 2 Outlook, provided to clients of MBMG.

Flash subscribers can also receive this by replying to this email requesting a copy.

Click >> REQUEST MBMG OUTLOOK Q2/2022

Sign up for MBMG newsletter from Co-founder & Managing Partner Paul Gambles

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.