It's always a good idea to have some protection...

Why we favour equity strategies with protection at this time Avoid the risks of unprotected equities….

The fundamental outlook today (both for economic and market conditions which dictate the future prices of assets) is extremely unclear.

Certain factors are positive (seemingly robust employment and wages data, low default rates, expectations of a ‘pivot’ to a policy of cutting rather than reducing interest rates).

Many other factors are negative (private debt levels seemingly having peaked, tight economic and commercial conditions and heightened geopolitical tensions, including sanctions and other supply disruptions).

While there is always a balance between positive and negative factors, today these are a far bigger scale (debt levels are higher, geopolitical stakes have been raised above anything experienced since World War 2) and therefore the risks of a major economic, capital market, financial, political or military disaster might arguably be even higher than in 1974, 1989, 1997, 2000 or 2007 when the world experienced financial or market crises but it is far from clear if or when such a crisis might occur.

Havingh to fight this heuristic tendency to disregard the distant past and treat the recent past as the normal, inevitably prevailing condition makes the process of investing particularly challenging.

Most investment strategies are calibrated on what might be termed normal times.

The crisis of 2008 was severe at the time:

But over time, both the statistical impact and the living and institutional memory of that crisis faded. The falls of more than 50% from that period are barely noticeable on a chart today where the current drop of 20-30% seems a bigger problem-

The global financial crisis destroyed businesses and wealth but doesn’t really influence most investment strategies today which don’t take seriously the risks of another multi-year crisis.

Markets seem to prefer to rely on complacent reasoning such as the statistic that when equity markets fallen in a calendar year, then for 75% of the time, they gain in price the following year.

However, in our view, this is not a source of comfort:

The data set for this is too small to be dependable.

Even then it means that there is a 1 in 4 chance that 2023 will be a second consecutive negative year (actually the past 5 negative years have all been single year declines so we may be well overdue another multi-year crisis).

The past 5 declines have been single year declines (we are riding our luck if we don’t acknowledge that we are overdue a major crisis).

Multiyear declines have historically tended to get worse as they have gone along (the second year has been worse than the first and when there has been a third year that has been worse than the second).

Last week’s column by renowned Bloomberg columnist, John Authers, summed this up-

“ US rates markets currently price….an imminent banking crisis-driven recession that forces the Fed into reversing its hikes within a few months. At the same time, however, equity markets…. have been rallying (on the prospects of lower interest rates). Taken together, this implies a kind of ‘immaculate recession, ‘whereby a contraction in output helps to usher in lower interest rates but without much painful effect on equity earnings."

Such an immaculate recession is conceivable.

It’s not very likely. Will Denyer of Gavekal Research makes the following suggestions:

"Investors are advised to seek shelter mainly in Treasury bonds. An allocation to gold makes sense as it is a “robust” asset that will benefit when the Fed is ultimately forced to ease policy. But with the central bank still in tightening mode and real yields decently positive (if deflated by inflation expectations), Treasuries are the preferred asset. It is far too soon to bet on US equities, which have yet to price in a disinflationary bust (aka recession), and unlike bonds, that repricing will not be upward. ”

This echoes much of our thinking.

As well as these fundamental concerns, the technical picture for stocks is unhelpful.

Technical analysis involves assessing the direction or trend of an asset price based on transactions up to the current time, showing where the market will go if the direction doesn’t change.

When directions inevitably do change, the technical analysis will suddenly tell a different story.

Today, the technical story is also very unclear.

In the chart below, as long as the S&P 500 doesn’t fall below the rising blue line which is drawn from the 3 low points over a 6 month period on which the index closed, then a ‘support’ may form that can become a minimum level above which the S&P 500 price trend remains (this is the problem with trends – they are self-fulfilling while they last but then they can change completely).

But a much stronger trend than the line between just 3 low points over a 6-month period is the resistance line, where, over the last 12 months around half a dozen rallies have fallen short, in some cases a long way short of the red line-

At some point the downward and upward momentum arrows will collide and a new trend, up or down, will emerge but at this time, technical analysis can’t tell us what the new trend will be except that the downward momentum is currently more powerful than the upward trend.

In short, even more than is usually the case, markets, especially equity markets, might either rally strongly or fall quite horrendously (or anything in between).

Completely avoiding equity markets would not only excludes investors from participation in any rally but also once investors leave equity markets, how do they decide when it’s safe to go back in again.

These conditions have been evolving for some time now, during which we have advocated a ‘protected’ approach to equity exposure such as long short equity funds that temper the gains of rising markets by shorting stocks in order to generate some offsetting returns in falling markets.

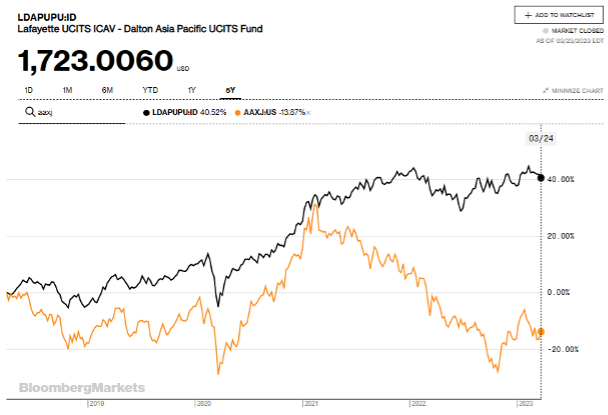

This has proven effective over the medium term but has really outperformed over the last year or so as the following chart shows(black line is a long/short equity fund favoured by MBMG IA, orange line is the Asia Pacific Ex-Japan Equity Index ETF):

Another ‘protected equity’ strategy that has performed well has been the use of forward contracts. In the following example the black line is a fund that uses Artificial Intelligence (AI) to determine from market signals (those same trends used in technical analysis) how much exposure to global equity indices (in a range between a minimum of 0%and a maximum of 90%) the fund should have. This has worked particularly well over the last 12 months:

We often criticise the marketing departments of investment firms for looking for strategies or assets that have been working well and then rushing to promote them, often too late.

In this instance we would make two points:

MBMG IA has advocated long/short strategies since our inception well over a decade ago and advised increasing exposure to these assets at various times during the last 5 years although now, we’d categorise as a ‘strong hold’.

We have favoured quantitative hedging strategies for much of the last decade and the AI managed strategy shown above since its inception almost 6 years ago.

Both approaches have proven to be ideal tools for the job of navigating markets, especially in recent years and at this time remain appropriate ways to protect your portfolio equity exposure, although when conditions change we will re-assess their relative attractiveness.

But for now, you might want to avoid the risks of unprotected equities….

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum.