This month, our commentary section, The Backdrop, brings together many of our recent themes. Questions remain as to whether interest rate expectations will continue to soften as they have since the middle of the month, whether that will be supportive for risk assets, whether severe recession can be avoided, whether geopolitics poses an existential risk, how many boozy parties Boris Johnson attended during lockdown[1], what Amber Heard did to Johnny Depp (or vice versa),[2] what Coleen Rooney did to Rebekah Vardy (and vice versa),[3] and whether, having driven economies to the edge, policymakers can pull back and avert disaster.

Not forgetting to ponder how much impact the re-opening of Thailand’s pubs, bars, karaoke venues, massage parlours and similar nightspots will have on the local economy.[4]

Some of those are way above our paygrade….but as always, we’ll do our best.

Our analysis section, The Technicalities, features the second part of the extended series of articles that we have written about the history of The Ukraine.

Hazy, crazy days of summer?

Although June can be a volatile month for stocks, the S&P 500 has, on average, ended the month flat. But averages can be misleading – a roller coaster comes back to exactly the same place where it started but the journey can be dramatic. There’s no reason to assume that June 2022 won’t be a white-knuckle ride, although there are as many reasons to believe that it will end at a higher level as at a lower one.

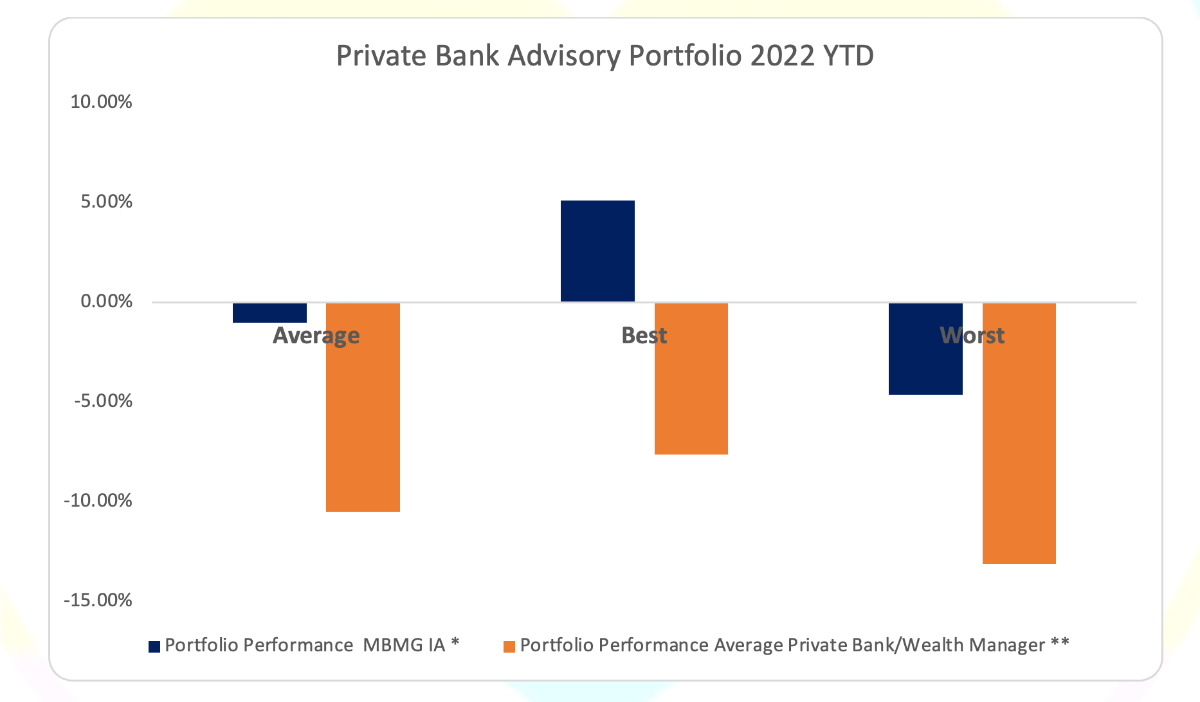

MBMG Portfolios based on the average performance of MBMG IA’s private client portfolios of USD 1 million or more, from 1st January 2017 to 31 May 2022 (based on latest actual & estimated data to 31 May 2022).

Average US$ portfolios based on estimated ARC Research Private Client Indices from 1st January 2017 to latest available actual & estimated data to 31 May 2022) - https://www.suggestus.com/pci.

MBMG’s average private client advisory portfolios have generated cumulative gains of almost 52% over the last 5 years and 5 months. This equates to almost double the return of the average wealth manager portfolio across all asset classes and is equivalent to an annual rate of return (CAGR) of 8.2%.

The average MBMG advisory portfolio loss of -1% year to date compares favourably with the average wealth manager loss of -10.5% for the same period:

MBMG IA remains hopeful that our advisory portfolios will continue to be able to report only one losing semester since their inception at the beginning of 2017, whereas the average manager portfolio looks highly likely to record a third negative semester.

June, she'll change her tune

In restless walks she'll prowl the night.

-Simon & Garfunkel

The Backdrop

Stocks (the S&P 500, black line), long US treasuries (25-year zero coupon strips, the orange line) and gold (the blue line), all fell in the first half of May before rebounding in the second half:

The primary driver of these moves was the turnaround in inflation expectations as the impacts of the latest supply shock started to fade.

This also fed (pun intended) through to USD, as the greenback faded in the last few weeks.

JUNE OUTLOOK

The trend that has dominated 2022 may have paused.

This is in line with our expectations in previous outlooks.

The first question now is whether this is a temporary pause and whether more supply issues will lead to further inflationary spikes and economic policy mistakes.

The second is whether the economic policy mistakes already made will cause lasting damage to activity and to corporate profits and to share prices.

The third is how much more damage policymakers will inflict.

The answers will be revealed in coming weeks and months and are based on too many variables to reliably forecast, but policy increasingly looks misguided, a form of Kabuki theatre that could well run until the US mid-term elections.

[1]https://www.theguardian.com/commentisfree/2022/may/29/sue-grays-report-is-like-a-surrealists-bad-dream

[2] https://www.independent.co.uk/news/world/americas/johnny-depp-amber-heard-trial-winner-verdict-jurors-b2091424.html

[3] https://www.theguardian.com/lifeandstyle/2022/may/28/wagatha-christie-vardy-v-rooney-celebrity-trial

[4] https://www.bangkokpost.com/business/2317842/june-1-easing-meaningless-nightspots

Request Full Report - MBMG Investment Advisory Report and Outlook 1st June 2022 available on request from info@mbmg-investment.com

Our latest Flashes and Special Offer ....👉🏻 Click 👈🏻

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.