Why is this a problem?

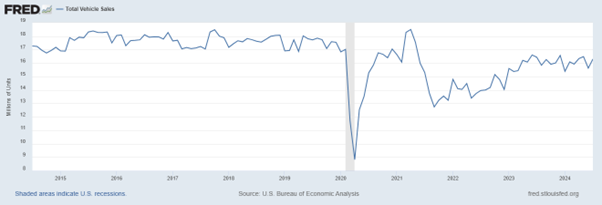

It would have been far better for one-time (or three-time) universal income boosts to have been spread over time, rather than concentrated at times when supply chains were compromised. The mismatch between artificially clustered demand and situationally constrained supply let the ‘inflation genie’ out of the bottle. It’s taken over 3 years so far to put inflation back in the bottle. The short-term wealth effect for the majority of Americans (which resulted in temporarily boosted spending) has been supplanted by a longer-lasting poverty-effect phenomenon. This effect has been generating a negative feedback loop to the economy that has been evident for some time in a range of metrics, including new vehicle sales (lowest level for a decade):

Broad retail activity has stagnated for the past year:

The narrative that surging property transactions following the pandemic released pent-up demand which would usher in a new property bull market hasn’t worn well:

In short, the US, and in varying degrees, the global economy has been running at 2-speeds for a while. Or rather the financialised economy of capital markets has been running hot while the real economy of wages, manufacturing, retail etc has been slowing to stall speed.

This is a direct consequence of the impact of monetary policy primarily on the labour market and fiscal + unconventional policy on capital markets.

next week we’ll take a look at why the ‘real’ economy is performing so much more poorly than the financialised economy.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum.

Thanks for reading MBMG Flash! Subscribe for free to receive new posts and support our work.