This note was written for clients after witnessing the spectacle of so-called ‘liberation day’ when Mad-Hatter Trump dictated that the US economy shoot itself in both feet. In hindsight, April 1st would have been more fitting than April 2nd. Although some of the comments here have been overtaken by events (including an uptick in GDPnow that some readers might find counterintuitive), we hope that there is still some useful content and some valuable explanations herein. This piece references Boom Finance and Economics - they have also issued subsequent updates since this was written which we’d strongly commend. We don’t trust politician speak whether about ‘liberty’ or ‘levelling up’ but in this case, just as through the looking-glass, everything is backwards and America’s President is threatening to level down……

Alice sat down in a large arm-chair at one end of the table…

Alice: But I don’t want to go among mad people.

The Cat: Oh, you can’t help that. We’re all mad here. I’m mad. You’re mad.

Alice: How do you know I’m mad?

The Cat: You must be. Or you wouldn’t have come here.

Alice Through The Looking Glass - Lewis Carroll

Neo-Liberation Day

The word ‘liberty’ and most derivations of it (e.g. liberal, liberate, liberation) tend to terrify us, especially when they fall from the mouths of the political classes. This is not because we oppose the basic concept of freedom – in fact the opposite, we strongly endorse the idea of genuine freedoms. But we’re extremely wary of politicians bearing ‘liberty’ – usually the more vocally they espouse the concept, the less they actually support or implement the practice of it. In many cases, to be a successful modern politician involves taking the leap through Alice’s ‘looking glass’ to a world where everything is backwards. [1] An erudite, knowledgeable reader recently sent some interesting insights on potential explanations of the mental state of Donald Trump and how that might impact policy decisions – we hope to visit these in future commentaries but for now, we’ll try to focus more on the consequences.

The immediate impact of President Trump’s “Liberation Day” has been a sharp increase in recession expectations and a sharp fall in risk asset prices.

Recession Expectations

The Atlanta Fed created a more empirically based ‘GDPnow’ measuring tool, largely because of the repeated failure of other statistical models in recognising when the US economy had fallen into periods of contraction rather than growth.[2] The latest GDPnow release was on April 3rd and therefore contained only inputs related to tariff expectations and not to the actual introduction of tariffs:

However, even prior to ‘Liberation Day’, GDP now was expecting a significant contraction in quarter 1 GDP[3] . It’s hard to imagine that things have improved (the next release is due Wednesday, April 9th). The Atlanta Fed’s real time GDP measure isn’t the only alarm bell that was ringing prior to ‘Trump Day’.

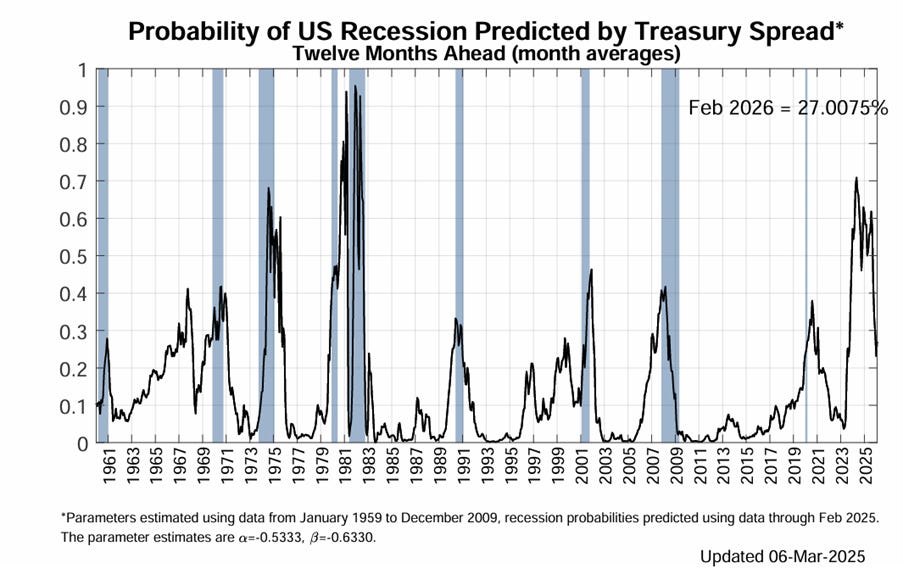

Treasury spreads have been indicating imminent recession since the end of 2023:

In the last 65 years, every recession has been preceded or accompanied by a run-up in treasury spreads. In the last two decades of the 20th century, there were 3 occasions when spreads rose above 0.2 but no recession eventuated. There has been no occasion in recent times (the last 65 years) when spreads rose above 0.3 without a recession occurring. Last year, they peaked at over 0.7 (levels only seen in the period from 1980 that saw the only recession comparable in length to the Global Financial Crisis of 2007-2009 and the 1973-75 oil shock. Another empirical metric is the so-called Sahm-rule:

However, the Sahm rule isn’t intended to predict recession, so much as help to recognise the need to apply policy-stabilisers once recession has begun (because policymakers are so bad at recognising recession that history is replete with denials often long after downturns had taken root). The Sahm rule, at best, is telling us that we’re not yet mired deep in recession already.

But it seems generally accepted that the US economy was facing elevated recession risk anyway.

A week ago the likes of Goldman Sachs and JP Morgan rose their estimation of recession occurring in 2025 to 35% and 40% respectively. Following the tariff hikes, these odds have been increased to 45% and 60% respectively.

We’d actually see the risk as somewhat higher noting that we believe that recession is still avoidable but that we believe the odds of policy decisions being taken to avoid or prevent recession becoming increasingly minimal by the day.[4]

There has been no shortage of commentary about Trump Tariffs. Much of this is misleading or at best right contains correct conclusions achieved through the wrong processes (‘right for the wrong reasons’).

We’ve repeated a couple of observations from that narrow cohort of economic commentators that we believe truly understands the impact of tariffs:

“TARIFFS – INFLATION IN THE USA AND DIS-INFLATION EVERYWHERE ELSE - IS THIS ECONOMIC & GEO-POLITICAL SUICIDE FOR THE USA?[5] – Boom Finance & Economics

Last Wednesday, on so-called “Liberation Day”, Donald Trump declared a Trade War against the rest of the world (mostly). This will not endear him to his citizens who will be hit with higher prices for many goods. This will also not endear him to many nations that export goods to the USA. If they can, they will abandon that market and rapidly find more friendly customers elsewhere outside the USA. BOOM suspects that the phone calls have been made already.

The Net economic effect will result in generally higher CPI inflation inside the USA and lower CPI inflation in all other nations. China will flood the world outside America with cheap goods. And they will seek trade settlements in currencies other than the US Dollar. As a result, the US economy and US Dollar domination will be harmed. A falling US Dollar will also add to CPI inflation inside the USA.

In all of this, Trump paints the USA as some sort of ‘poor victim’ by saying ‘they have taken advantage of us’. But no one will be listening. Nobody outside America sees the US as a victim.

President Trump announced the so-called reciprocal tariffs on imports from about 60 nations, in addition to a 10% across-the-board tax applied to all imports to the US. The new tariffs will be additive, meaning that imports into America will face both the universal tariff of 10% plus the specific reciprocal import levies targeting each nation. The reciprocal rates will become effective at 12:01 am on April 9th. That's in addition to the baseline 10% tariff which went into effect at 12:01 am on April 5th.

The nations most affected by reciprocal tariffs are – in order of effect --

Laos 48 %

Madagascar 47 %

Vietnam 46 %

Sri Lanka 44%

Myanmar 44 %

Bangladesh 37 %

Serbia 37 %

Botswana 37 %

Thailand 36 %

China 34 %

Taiwan 32 %

Indonesia 32 %

Switzerland 31 %

South African 30%

Pakistan 29 %

Tunisia 28 %

Kazakhstan 27 %

India 26 %

South Korea 25 %

Japan 24 %

Malaysia 24 %

Cote d’Ivoire 21 %

European Union 20 %

Jordan 20 %

Nicaragua 18 %

Israel 17 %

Philippines 17 %

All other nations will see a 10 % reciprocal increase in Tariffs while some will see no increase e.g. Russia.

Note that China (34 %), Taiwan (32 %), South Korea (25 %), Japan (24 %), India ( 26 %) and the European Union (20 %) are the major economies affected outside the USA. This is clearly an attack on those economies. Trust in the US as a reliable trading partner is now damaged and will be hard to repair.

On February 16th, Boom had a lot to say about Donald’s economic policies in TRUMP’S PLAN FOR AMERICA. Here are some excerpts worth reviewing --

“BOOM does not think it will work as planned for obvious reasons. It is essentially a magical thinking “solution”, a glorious dream, to America’s terrible economic, social and cultural problems which are deeply embedded after many, many decades of poor economic management, adversarial thinking, endless warfare and the malevolent influence of what many call the “Deep State”. And it focuses too much on a manufacturing resurgence and a much lower price of energy. It also sees the rest of the world as “the enemy”/”adversaries” which have to be subdued. There is no acceptance of multipolarity as a viable future. This is a Roman, Imperial viewpoint."

“They (Trump and Bessent) are missing the fact that the US economy is overwhelmingly dominated by the provision of services and not manufactured goods. And they are missing the reality of the aspirational policies of the BRICS nations to create a Multipolar world for 7.5 billion people who do not live in the USA. Glorious economic isolation with a dominant global currency is ultimately a Pipe Dream, devoid of consideration for other nations.”

Is this just a Trump Negotiating Tactic?

Of course, there is the possibility of this Trump Tariff announcement being just an opening gambit by Trump, the first step in negotiating new “trade deals” with each nation (or group of nations). We will soon know if that is the case. However, such a strategy is fraught with the risk of damaging America’s international reputation. After all, these are not business deals we are discussing here. They are part of the delicate Geopolitical mix, part of the global conversation and not something to be treated lightly. Diplomats do not step on each other’s feet at meetings.

Trump was also reported as saying about US car prices that he “couldn’t care less” if automakers raised their prices due to increased Tariffs. If that is true, then it would appear that he is content to insult his citizens just as easily as he insults trading partners. That is bad karma, surely.”

More succinctly, Professor Stephanie Kelton recently reposted a chapter from here excellent treatise, The Deficit Myth

Professor Kelton again focuses on how superficially attractive appeals to the lowest common denominator can be powerful. However, reverting again to Edmund Blackadder’s analysis, these appeals also contain the one tiny flaw that they too are utter bollocks.

If The Deficit Myth is beyond the understanding of Donald Trump (regular readers will know how strongly we recommend that the book should be universally read and taught) and if Professor Kelton fails to adopt Professor Steven Hail’s suggestion to create a cartoon version of the book for teaching in infant schools and at The White House, then maybe a better way for the Trump 2.0 administration to look at tariffs is to consider the explanation in Professor Ha-Joon Chang's Kicking Away the Ladder about the policy decisions of the Portuguese and British Empires in the late 18th century. Portugal was persuaded to focus on the global wine trade while Britain could do everything else. This may have been good in the short-term for producers of Vinho Verde (the first reported exports to Britain occurring in 1788[6]) but basically enabled the British Empire to be in pole position for global exploitation on the back of the industrial revolution.

Economists of the day believed that this division was justifiable for both Britain and Portugal, although before too much longer, it was primarily only British economists, such as David Riccardo who continued to justify this division of spoils as a win-win. Professor Steve Keen has pointed out the fallacy of this thinking, highlighting why so many economists united I their criticism of Trump are ‘right for the wrong reasons’ as mentioned earlier:

“Belief in the advantages of specialization lies behind the incredulity with which economists have reacted to the rise of populist politicians like Donald Trump in the United States, as well as the United Kingdom’s vote for Brexit. They have, at their most self-righteous, blamed the rise of anti-globalization sentiment on the public’s irrational failure to appreciate the net benefits of trade. Or, more commonly, they have conceded that perhaps the electorate has reacted negatively because the gains from trade have not been shared fairly.

There is, however, another explanation for why anti–free trade sentiment has risen: the gains from specialization at the national level were not there to share in the first place, for sound empirical reasons that were ignored in Ricardo’s example. That ignorance has been ingrained in economics since then….Ricardo assumed a crucial and false equivalence between physical machinery and monetary capital that has bedevilled economics ever since: he treated the specialized machinery in different industries as if it were equally as liquid (and so could be as easily repurposed) as the money with which it had been purchased.

The gain from trade arose, Ricardo asserted, because of different production technologies in different countries (whether that was due to different labour skills, different weather, or different machinery)…..monetary capital moves easily in search of a profit—today, even internationally. But machinery is specific to each industry, and the crucial machines in one industry cannot simply “move” to another without loss of productivity.

The archetypal machines for cloth and wine manufacturing in Ricardo’s time included the spinning jenny and the wine press. It is stating the obvious that one cannot be turned into the other, but stating the obvious is necessary, because the easy conversion of one into the other was assumed by Ricardo, and has been assumed ever since by mainstream economic theory…..Machinery designed for one industry simply cannot move to any other, even in the same country; but machinery in one industry can (and frequently is) shipped between countries.”[7]

This lies at the heart of the tariff problem. Trump 2.0 is essentially a proposal to repurpose trade, commerce and finance. With its unrivalled accumulated capital and political/military power, America today dominates global markets in a way that previous empires were unable to even dream of. Trump is threatening to tear down that dominance – to replace higher value, unfair trade advantages with a much more level playing field (to America’s cost), and effectively acting in a way that only be compared to if the Eton-educated leaders of the British Empire had turned round at the peak of that domain and, ignoring all the benefits that had created British dominion wealth extraction, had said ‘Look, this whole thing is unfair – why should Portugal get to export wine and we don’t? Let’s tear this deal up and start again.’ Of course, there was nobody so ill-advised to demand that colonial ‘victory’ be turned into defeat. Otherwise, much of the global south would be much better positioned today. However, that is precisely what Trump is seemingly intent on doing to the American imperial project. Maybe, in the long run, that might create a more equitable, more sustainable world. Interestingly, Professor Ha Joon Chang doesn’t dismiss out of hand the idea that the US economy has room to include a manufacturing base, which in doing so presumably includes a broader net that captures disaffiliated, low-skilled workers who seem to provide some support for Trumpian policies, although he has doubts about whether America is willing to undertake that hard journey-

“It is going to take a lot of time, and you don't have that time. You have run down the industrial base over the last four decades. It cannot be built up in two years or whatever tariff policies that you have. In the meantime, things will be very expensive, especially if you are putting tariffs on the main trading partners like Mexico and Canada. And can people tolerate any more inflation?” [8]

A deeper question might be to what end they should tolerate that level of change when much more progressive solutions like the job guarantee scheme promoted by Professor Pavlina Tcherneva and others.[9]

So basically, from an American perspective, Trump tariffs are a terrible policy idea and the log-term damage may far exceed whether or not tariffs trigger the recession that was likely anyway but now is being seen as increasingly inevitable. This will have a huge knock-on effect on the global economy but does at least give some hope that the economy can be rebuilt in a way that will be more equitable and sustainable. We doubt that will happen, suspecting that the bounty currently enjoyed by the US economy and very narrowly distributed will simply be appropriated elsewhere. As European policymakers seem no more competent than US counterparts, then maybe, if humanity survives it, this might be Asia’s century once again. This would be ironic as so much of the visceral support for Trump tariffs stems from antipathy towards China as a geo-economic competitor. Professor Ha Joon Chang talks of the opportunity to forge a new world order on the back of Trump’s tariff revolution. This raises so many questions but not least – ‘can we get there without a catastrophic global conflict?’

[1] “Through the Looking-Glass, and What Alice Found There (also known as Alice Through the Looking-Glass or simply Through the Looking-Glass) is a novel published on 27 December 1871 by Lewis Carroll, a mathematics lecturer at Christ Church, University of Oxford, and the sequel to Alice's Adventures in Wonderland (1865). Alice again enters a fantastical world, this time by climbing through a mirror into the world that she can see beyond it. There she finds that, just like a reflection, everything is reversed, including logic (for example, running helps one remain stationary, walking away from something brings one towards it, chessmen are alive, nursery rhyme characters exist, and so on).” - https://en.wikipedia.org/wiki/Through_the_Looking-Glass# Notable quotations that help to exemplify the exposition of reality as nonsense and vice versa include “ Nothing would be what it is, because everything would be what it isn't. And contrary wise, what is, it wouldn't be. And what it wouldn't be, it would” and “Well, now that we have seen each other," said the unicorn, "if you'll believe in me, I'll believe in you” and “It's a poor sort of memory that only works backwards,' says the White Queen to Alice” and perhaps most famously –

“Alice laughed. 'There's no use trying,' she said. 'One can't believe impossible things.' I daresay you haven't had much practice,' said the Queen. 'When I was your age, I always did it for half-an-hour a day. Why, sometimes I've believed as many as six impossible things before breakfast.”

[2] The Atlanta Fed states “The growth rate of real gross domestic product (GDP) is a key indicator of economic activity, but the official estimate is released with a delay. Our GDPNow forecasting model provides a "nowcast" of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis….. The Atlanta Fed GDPNow model also mimics the methods used by the BEA to estimate real GDP growth. The GDPNow forecast is constructed by aggregating statistical model forecasts of 13 subcomponents that comprise GDP. Other private forecasters use similar approaches to “nowcast” GDP growth. However, these forecasts are not updated more than once a month or quarter, are not publicly available, or do not have forecasts of the subcomponents of GDP that add “colour” to the top-line number. The Atlanta Fed GDPNow model fills these three voids.” - https://www.atlantafed.org/cqer/research/gdpnow

[3] Gross Domestic Product – an intuitive but imperfect way of measuring activity within a location during a particular period - usually calculated (there are alternative methods, all intended to produce the same results) as GDP = C + I + G + (X - M), where C = consumption, I = investment, G = government spending, X = exports and M = imports. We focused on GDP in our outlook for November 2003 (coincidentally issued exactly one year to the very day before the Presidential election last year), concluding that using GDP metrics to determine economic policy is “akin to using lump hammers to fine tune a concert piano”. Change in GDP = the GDP growth (or contraction) rate. Governments generally love to talk about economic growth (even though they typically don’t understand it) which places a huge significance of GDP growth rates. You can see from the formula that government spending is a positive component of GDP whereas imports are a negative component. Therefore, superficially, it might appear that to a government determined to cut government spending (as many Republican voters and Trump supporters have spoken in favour of, usually in the same breath as they are talking about tax cuts for corporates and high-income earners), the reduction in economic growth caused by cutting government expenditure could be offset by simply cutting imports. The best way to explain the deficiency in this plan is to appropriate the explanation used in BBC sitcom Blackadder on why escalating military deterrence failed as a method of preventing war

‘Edmund “You see, there was a tiny flaw in the plan.”

George: What was that, sir?”

Edmund “It was bollocks.” ‘

[4] There are a number of reasons for this and in a future outlook we intend to focus on what we see as the main factor – namely that Donald Trump (and his sidekick, Elon Musk) strikes us as like Herbert Hoover (and Andrew Mellon) in being a DC ‘outsider’ – which we think will impact US policymaking co-ordination in a similar way to the period from 1929-1933.

[6] https://web.archive.org/web/20070822135024/http://www.vinhoverde.pt/en/historia/cronologia.htm

[7] https://americanaffairsjournal.org/2017/08/ricardos-vice-virtues-industrial-diversity/

[8] https://www.pbs.org/newshour/show/examining-trumps-claims-that-tariffs-will-revitalize-american-manufacturing

[9] Professor Tcherneva’s book The Case for a Job Guarantee is also essential reading https://pavlina-tcherneva.net/the-case-for-a-job-guarantee/

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they acknowledge all risks and have been informed that the return may be more or less than the initial sum.