In the previous episode of White House or the Big House (https://mbmg.substack.com/p/mad-hatters-t-for-tariff-party) -

Recession might or might not be coming anyway (USA & globally) – tariffs may be the straw that breaks the camel’s back but broader policy dysfunction is the main drive;

It remains possible to position for this and expect to generate decent returns this year;

Longer-term, it could prove disastrous for America and the world but with Trump, he loves grand gestures – hopefully, he’ll claim some kind of a win here (I saw some commentary that he sees himself as a mediaeval monarch and that when emissaries from foreign lands bring tribute to the Donald/ Trump Corp, that he’ll lose interest in this)

But since then…..Everyday in the new Trumpian world is like driving on the opposite carriageway to a terrible accident – you really want to look away but a part of you can’t resist the instinct to observe the mayhem.

Apologies if the phraseology of what follows sounds at all conspiratorial or even slightly mad – I don’t know any other way to describe the various levels of power and agency within the state without resorting to definitions that take thousands of pages or using deeply socio-politicised terminology and jargon (that I’m neither particularly comfortable or familiar with). We admit that we failed to anticipate the specific nature of the prevailing chaos. We may have overestimated the effect of the good points of Trump (he’s not Biden, he’s not a prototypical modern politician in the Machiavellian manner) and underestimated the consequences of the bad points (he is Trump, he is even more dangerous than the prototypical Machiavellian modern politician).

In our desperate straw-clutching, one thing that we had hoped might prove to be refreshing about Trump is that he’s not wedded to what Noam Chomsky has deemed ‘The Washington Consensus’.

The flipside of this is that the US establishment’s system perceives itself as being under threat from outsiders like Trump, which is why the system does everything that it can to remain closed and to preserve itself.

This makes the task of an agent of change (like Trump) seem more like a systemic threat in reality we believe that it’s more a case of Trump wanting to capture and appropriate the most oligarchical, discriminatory elements of the system for his own benefit) but either way, this is unlikely to go unchallenged by the incumbent power brokers, their level of challenge increasing in response to their level of perceived threat to their own demesne.

It was also to be expected that placing the controls of the mechanisms of state in such ‘revolutionary’ hands (albeit soft, little revolutionary hands - https://abcnews.go.com/Politics/history-donald-trump-small-hands-insult/story?id=37395515) would lead to mistakes and therefore that ‘the Guardians of the Washington Consensus’ would pounce on these (and indeed pounce on radical policies that weren’t actually mistakes but could be presented as such, especially if these policies were counterintuitive or against the received wisdom that has, for decades underpinned the narratives propagated by the ‘Guardians’).

What Trump 1.0 did that was ‘clever’ (like a rabid Fox News) was to appoint figures like Pompeo, Mnuchin and Bolton, who were prepared to carry out some aspects of the ‘Trumpian revolutionary agenda’ while at the same time looking and sounding like they were part of the establishment and/or Washington consensus (even though the likes of Mnuchin was to some degree a political outsider), in that it helped to confused ‘the guardians’ who were generally complicit because they felt that they could benefit (remember how markets panicked and then calmed in 2016 as the new of Trump’s ‘surprise’ victory filtered through, falling 6% in less than four hours, only to recover within half a day):

Markets at least, quickly decided that they could work with Trump 1.0, meaning that Trump 1.0 was effectively a willing coalition of

Many/Most Republicans (GOPs)

Some disaffected Democrats (Dems)

The real power behind the US throne, which absent any better description I’ll continue to term ‘The guardians of the Washington Consensus’ (or Guardians for short)

The following is not to scale (otherwise Guardians would not be readily visible to the naked eye if it were based on headcount whereas the other groups would be tiny in comparison if it were on net worth)):

However, Trump 2.0 appears to have taken a much more aggressive approach to policymaking, possibly in response to the experience of having the likes of a disaffected Bolton move outside the tent and start urinating and defecating inwards and the likes of Mnuchin unable to rally the political mainstream to the extent required to pass policies sufficient to ensure Trumpian re-election, and Pompeo unwilling to hijack the Capital on January 6th 2021, when Trump followers created violent pandemonium.

Therefore Trump 2.0 no longer looks as acceptable to the real power brokers in DC and may even be alienating those within the GOP most closely affiliated with ‘Big’ business interests (pharma, oil, banking etc):

Trump’s popularity with his base so far remains intact but that populism is likely to play even less well with the ‘Guardians’ who are rapidly becoming more distant from/antagonistic to Trumpism.

In addition to this, the likes of Musk are becoming increasingly exposed (not because they’re wrong [they frequently are, but that’s not what offends the ‘Guardians’] but because they’re posing the greatest threat to Washington’s hegemonic power structures at least since the Civil Rights/anti-Vietnam movements, probably since WW2 and possibly since the Declaration of Independence and the adoption of the US Constitution.

This is clearly leading to policy friction and broader societal incoherence.

Increasingly, the best precedent that we can see for this is the presidency of Herbert Hoover.

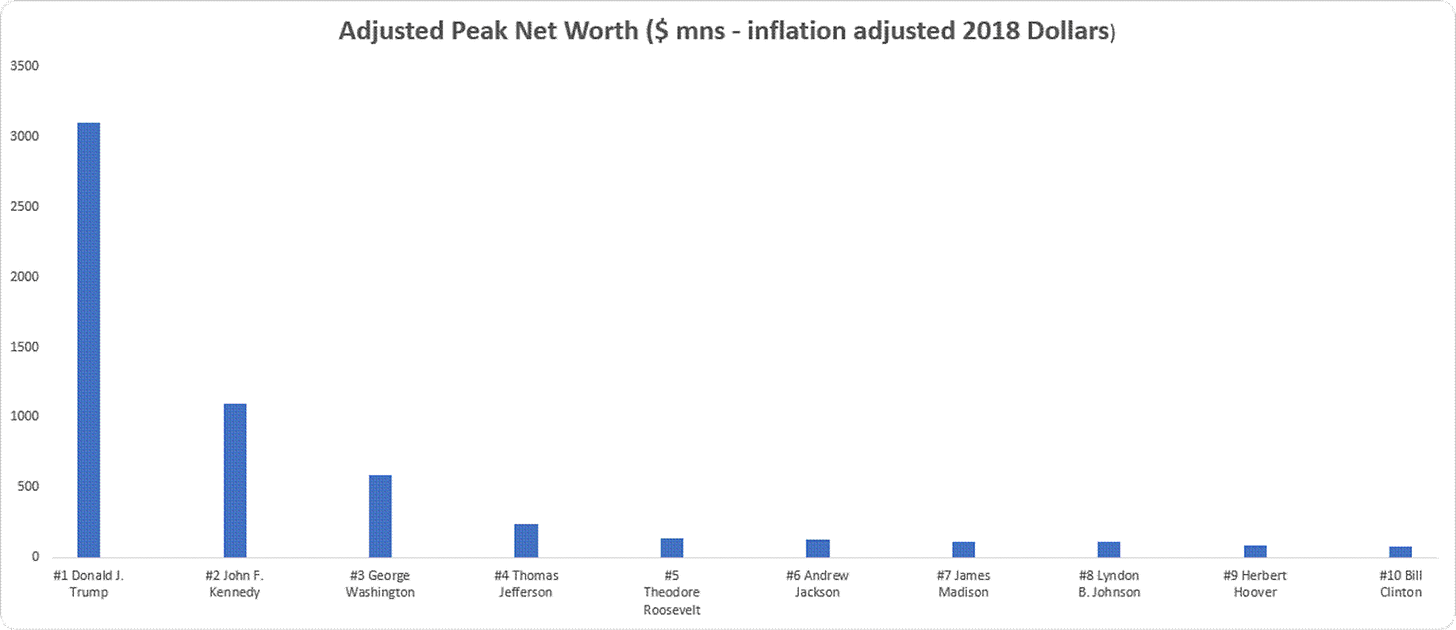

Hoover has been ranked as the 9th wealthiest US President:

However, although he had served in the Harding and Coolidge cabinets as Commerce Secretary for 8 years by the time he was elected President, Hoover remained a Washington outsider, partly because most of the other top ten had acquired their wealth in the true American way (the same way that wealth is most typically acquired globally but in other countries is recognised and celebrated as such), by inheritance (Kennedy, Washington, Jefferson, Roosevelt and Madison) or by marriage (Jackson and Johnson).

Clinton’s wealth has largely been generated post-presidency, monetising his political fame and influence.

Hoover alone on the list can be regarded as ‘self-made’ (if you can describe a mine operator exploiting immigrant labour in gold, zinc, silver, copper and lead mining in Australia, China, Burma and Russia as self-made) and therefore an interloper into the DC-set. Hoover was made more acceptable to the 1920s ‘Guardians’ by being paired with right hand man, Andrew Mellon, a favourite of early twentieth century American business and a firm believer in reducing taxation, lowering interest rates and reducing the national debt, policies that largely encouraged the explosion in private debt during the 1920s and created the conditions for the Great Depression.

Mellon favoured laissez-faire non-intervention, believing that the 1929 crash was simply a Wall Street correction with no broader economic impact and, based on this view, strongly supported the Smooth-Hawley Tariff Act of 1930, making Mellon the second most hated man in America, behind only his boss, Herbert Hoover. In his memoirs, Hoover wrote that Mellon advised him to "liquidate labor [sic], liquidate stocks, liquidate the farmers, liquidate real estate. Purge the rottenness out of the system. High costs of living and high living will come down. ... enterprising people will pick up the wrecks from less competent people."

Mellon had previously had a somewhat insouciant approach to personal compliance with legislation, which had been largely disregarded during the boom years but saw him impeached, removed from office and spending his final years holed up in DC, unable to return to his Pittsburgh home where he was vilified, facing (posthumously dismissed) charges of tax fraud. The problem with placing heroes on pedestals that are too high is that it increases the chances that expectations will be disappointed.

Hoover’s outsider status and misguided interpretation of macro-economics, encouraged by the business ‘genius’ of the day made inevitable the Great Depression, which, with more interventionist policies, might have been avoided, mitigated or at the very least, delayed.

Our worry is that Trump 2.0 is now headed down a similar trajectory.

We note the observations of Boom’s Gerry Brady-

“BOOM has clearly stated a preference for Trump over Biden as President. America desperately needed a change of Federal government after 4 years of uncertainty which ended in the possible provocation of a nuclear war with Russia.

But that is a comparison of relativity based upon pragmatism. BOOM has not suspended all critical analysis in a rush to join the Cult of Trump or his technocrat backers.”

There was a hope that change would come and it would be change for the better.

There is now an extremely significant risk that change will be severely detrimental, at least for USA and will be accompanied by extreme volatility.

This doesn’t mean the end of US economic and political hegemony but it does mean that in both the short and longer terms, US influence and ability to extract value from the rest of the word will be damaged. This poses an immediate and ongoing risk to US stockmarkets which perform at premiums which reflect this value extraction.

It doesn’t mean that the US Dollar will collapse or cease to be the global reserve currency, but it does imply swifter transition to a multi-polar world, with a long-term weakening of the US Dollar. Ignoring the spike during the US Civil War, the USD traded at almost 5:1 (4.86 being a rate often quoted during much of that period) during the period of British imperial dominance. The emergence of the USA as the major global power in the twentieth century saw increased volatility, especially downside volatility for the incumbent but during World War II, the rate was fixed at $4.03, which was continued under the rates fixed by the Bretton Woods agreement of 1944. Due to challenges that Britain faced in re-construction and the gradual loss of colonies in the post-war era, this was re-set at $2.80 in 1949, a rate that prevailed until 1967.

To the limited extent that this provides any guide, then we might expect a 25-30% or so depreciation of the Dollar over something like half a century or more – much less than 1% per year on average, although it might be expected to include violent episodes.

In terms of US Treasury Bonds, we continue to expect that policy can, despite fears of bond vigilantes, anchor the curve. It has recently been pointed out that the UK’s Truss-panic had far more lasting impact on the occupancy of 10 Downing Street than on the bond market. A short-term reaction reflected the unwillingness of the Bank of England to step up but that dissipated quickly, even before Truss was removed from office and rates are now higher today than during that episode. We’re seeing something similar in America right now and we continue to see this as a buying opportunity although it might require patience and a strong resolve. A British client just asked me what was the difference between the Liz Truss fiasco in the UK in 2022 and the Hoover disaster that led to The Great Depression. The short answer is that Truss was removed as PM after less than 2 months and disaster was averted but the fuller answer is deeper than that-

The Truss panic was largely a response to the Bank of England actively undermining Truss for various reasons (but in my view largely because she wasn’t ‘one of the BoE club’. Prof. David Blanchflower, an ex-MPC member, with completely different views to Liz Truss, has often shared with me his experiences as an outsider on the BoE Committee which indicate that clearly there is significant inherent bias in the way that BoE and central banks mor generally operate).

Trump is clearly doing many things wrong but the impact of most of these might not become apparent for very many years to come.

But he is also encountering the Washington version of the old boys’ network and so far they seem to be intent on sabotaging more than supporting.

However, the much less remarked point is that even before Truss was turned on by the 1922 Committee, UK rates were already falling again – even if the BoE remained on the sidelines, the invisible hand of market self-adjustment recognised that the interest rate response had been overdone. So, in that case, BoE’s undermining of policy had quite a short-lived impact.

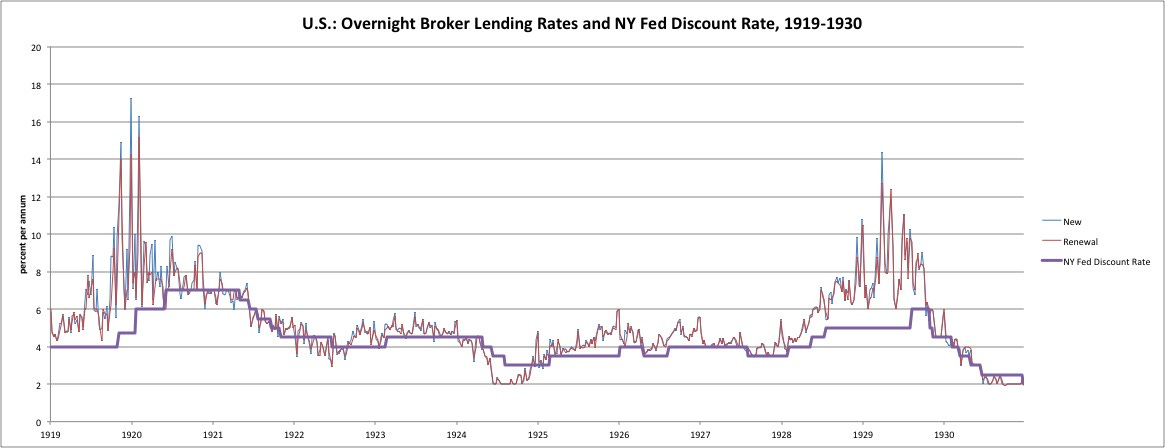

Even in late 1920s America, when policymakers were at odds with Hoover and fell out of love with Mellon, the so-called bond vigilantes could only express disapproval through higher rates for around a year (admittedly it was a sharp rise from a range of 4-5% to a range of 6-14% - a huge blow out in spreads). Within a year or so, they were back where they started but the damage was done and within 2 years, they had fallen all the way to 2% and USA was mired in The Great Depression:

Trump 2.0 may prove to be a longer-term menace to the US system, the US Dollar and possibly even the US treasury market as we know it, but that’s a poison pill for future generations, with consequences so far in the future that intermittent episodes of volatility are more of a concern than the ultimate direction of travel.

However, Trump 2.0 is very much a clear and present threat in real time to the US economy, the global economy and geo-political stability. But, for once, it’s not entirely the fault of The Donald.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with an advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they acknowledge all risks and have been informed that the return may be more or less than the initial sum.