Data released on July 13th 2021 confirmed the continued acceleration of US Consumer Price Inflation (CPI) through June, which was largely due to increases in used car prices, along with spikes in airfares, hotel prices and car hire rates due to demand driven by the relative enormity of the post-COVID ‘re-opening’ surge of the US economy.

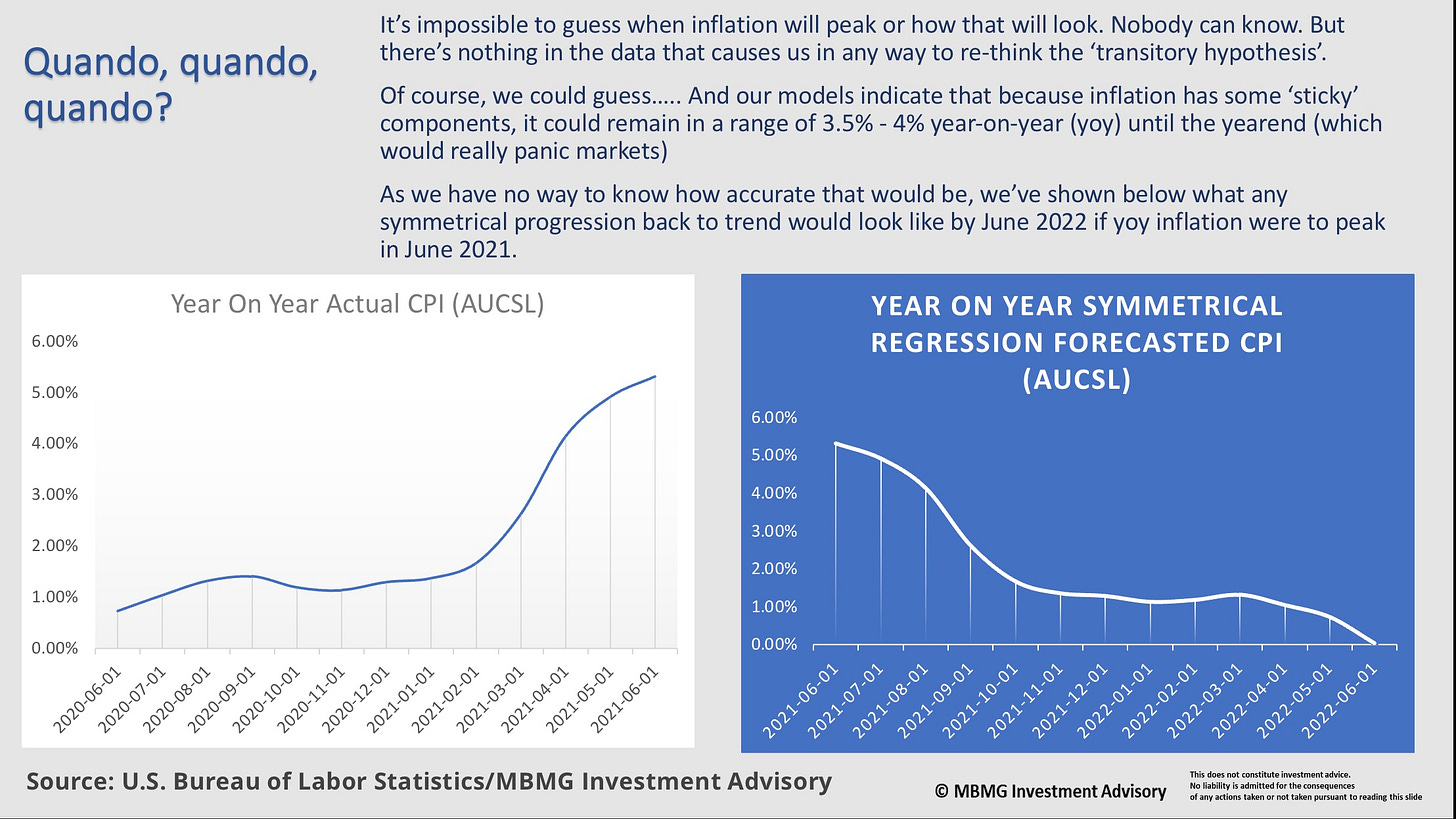

But is this unwelcome visitor likely to hang around? If not, when will it be gone? This brief snapshot produced by MBMG Investment Advisory tries to explain why it's impossible to know and so, when people ask us when, we say 'Quando, quando, quando (tell me when)?'

The following VDO link is of Paul Gambles walking us through the slides pictured below. These provide a summary of his guidance on CPI and the possible 'normalization' of it.

Please click on 'Find Out More' to view a closeup, personal view of the slides on our website.

High On An Inflation Panic

https://www.youtube.com/watch?v=eAFaZak0fhQ

Inflation Panic

But how transitory?

Quando, quando, quando?

MBMG Investment Advisory is licensed by the Securities and Exchange Commission as an Investment Advisor and is a member of the MBMG Group, Asia's leading advisory practice since 1996.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.

Copyright © 2021 MBMG Group, All rights reserved.