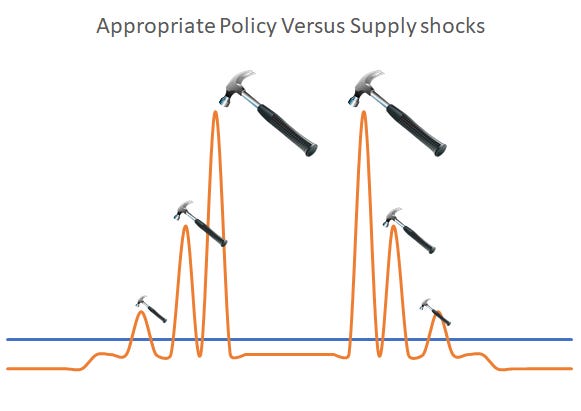

To a man with a hammer, everything looks like a nail…

To central bankers, who have never seen such a dramatic supply shock in their careers, all inflation is assumed to be excess demand.

When the world went into lockdown, America stimulated consumption while the world shut down (it was probably the right thing to do).

At the time this drove massive volumes through online channels - hence the ramp up in many new economy stocks - not that they’re bad businesses but that they were getting ahead of themselves because the surge in demand was neither organic nor sustainable.

A side-effect of this was the supply shock that we’ve seen since last year - basically not that there isn’t enough broad global capacity - there’s more than enough - but that there isn’t specific capacity to deliver the things that people want instantly or at least sufficiently quickly

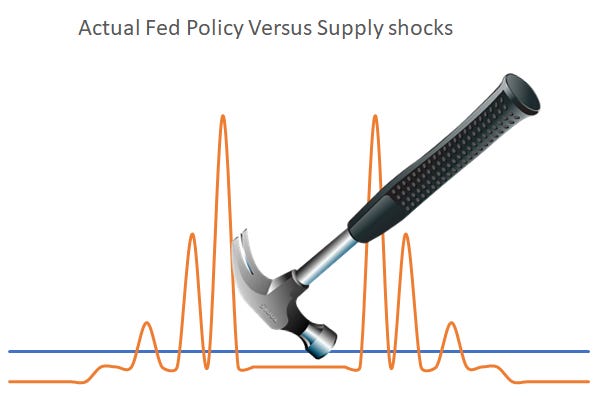

The reaction to this has been to move from easy, supportive, stimulatory monetary and fiscal policy, to much tighter policy (in most western countries).

I think that this is a bad mistake - and many of the people who are much smarter than me but with whom I’m lucky enough to interact, think exactly the same, namely that attacking the elevated prices as though this was a demand problem and trying to beat inflation down is a pretty crude response to a very nuanced logistical problem and that it runs the danger of the following outcomes:

Driving down demand across the board is basically a very dangerous policy in terms of the growth outlook: Demand is not the problem as we know from the fact that consumption in USA in 2021 was at a similar aggregate level to 2019 but the specific pattern - i.e who spent and what they spent on - shifted in the lockdowns.

An effect of this is that many businesses and households are struggling because of this shift - beating them all down will have disproportionate effects on lower income/more indebted consumers and on struggling businesses that are still way below where they were. Bankruptcies and defaults are a high risk outcome and would further impair the growth outlook.

It’s hard to really drag down the price of e.g. Pelotons by reducing broad demand. In fact, the price of Pelotons was already on its way down because people had bought the ones that they wanted but other in demand pandemic goods and services will similarly be affected more by the idiosyncratic demand for them specifically, than by higher interest rates pulling down aggregate demand slightly across the board.

For the 2 years of the pandemic lockdowns so far, (2020 & 2021), global economic growth is likely to have stagnated at just over 1% per year. There will have been significant variations, with China expected to have grown almost 10% in aggregate during the 2 years, while America is expected to have grown very marginally, perhaps less than 0.2% per year and the EuroZone is expected to have contracted by 4% or more in total over the period.

Because of this, we’re concerned that global growth is extremely fragile and that the removal of the exceptional policy support that enabled even such anaemic growth during the pandemic, will lead to a dangerous economic slowdown. Policymakers on the other hand seem more concerned about the inflation that we have seen from supply and logistic issues and intend to tackle this most aggressively in countries and regions where demand has clearly not yet recovered, such as USA and the Eurozone.

Why are they embarking on such a seemingly reckless course?

To a man with a hammer, everything looks like a nail…

To central bankers, who have never seen such a dramatic supply shock in their careers, all inflation is assumed to be excess demand

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.