In parts 2 & 3, we focused on the different causes of the different waves of inflation.

This final (psychotic?) inflation episode will try to pull the disparate points together before moving on to our next topics.

Americans, like citizens of all other countries, needed financial and other forms of support during the pandemic. The ham-fisted way that this was implemented, with no distinction between absolute need and relative affluence, filled a petri-dish that became the breeding ground for temporary inflation (which the 3rd round of stimulus payments in particular made into a steep bout of inflation) and lasting, greater inequality. The subsequent reaction of policymakers has widened this inequality even further and imposed economic damage that will likely come back to bite the vast majority of Americans. For all the political opposition, it would have been far better to focus on free healthcare, free education, improved infrastructure and above all meaningful measures to try to tackle or mitigate climate change.

However, policy merely ensured that the resumption in demand was not only compressed into a shorter timescale by re-opening effects BUT also but monetary stimulus – instead of a year’s discretionary consumption being compressed into a 6 month period, it was compressed into a much shorter period by spending patterns fuelled by distinct waves of policymaker credit creation and distribution to recipients whose marginal propensity to spend on dioscretionary items became elevated, in the short run, by a combination of lockdown in conjunction with healthy domestic balance sheets swelled by stimulus payments. Spreading the payments over a greatter timescale, targetting the most socio-economically vulnerable and directing focus of spending could, in hindsight, have generated more beneficial outcomes for the vast majority of recipients.

These effects were heightened by challenges encountered by the supply side during the ‘re-opening of the economy’.

Shipping Rates

The relationship between the inflation impact on supply constrained lumber and capacity constrained shipping prices, can be clearly seen as the concentration of demand into such short periods highlighted bottlenecks in the system, such as supply constrained goods and difficult to transport goods as freight channels were overwhelmed.

Similarly, passenger delays at airports unable to resume previous operating capacity this summer were horrendous. One of the worst examples was Toronto Pearson, where more flights have been delayed this year than have departed on time.[1] This despite passenger numbers rebounding from a low of around 10% to just over 1/3 of pre-pandemic levels. Airports around the world struggled to compress the process of recruiting, retraining, obtaining requisite clearance on employees and found themselves at breaking point handling what would previously have been well below capacity.

Initial supply shocks following COVID lockdown were a combination of logistical – supply chains weren’t immediately ready to turn on the taps again and sequential – the resumption of demand in uneven, almost violent fits and starts, causing bullwhip effects in disrupted supply chains.

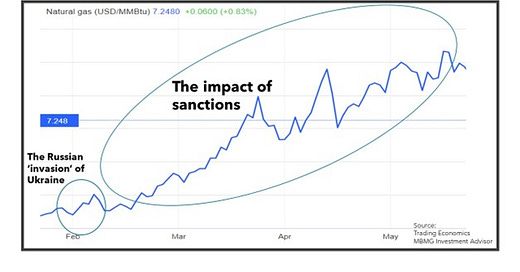

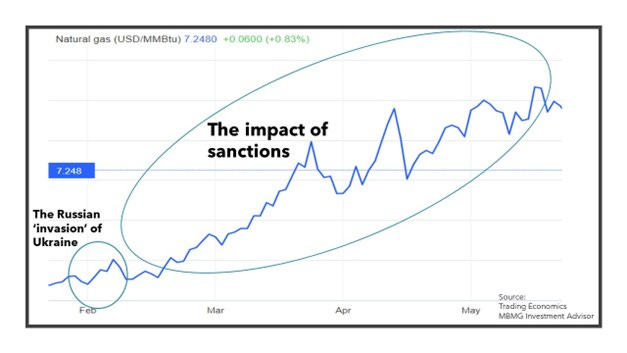

This year has seen a 3rd inflationary input, purportedly due to Russia’s special operations in the Ukraine region, but in reality almost entirely related to sanctions.

We published a paper in January highlighting the economic risks stemming from conflict in the Ukraine. These, in themselves, were not insignificant but the scale and scope of repeated sanctions has been a game changer. Michael Hudson who is probably one of the most intelligent people on the planet wrote a paper saying that actually this could be the beginning of the end of the US dollar dominated, US capital market dominated system, which would be the biggest, most disruptive change in our lifetimes. A second order effect has been America’s understandable willingness to encourage sanctions designed to harm Russia, even if these have a greater negative impact on regions such as the EuroZone, but which benefit America and American interests. Less understandable is Europe’s eagerness to play along with these. When supply shock and demand compression inflation had begun to ebb, the artificial scarcity of sanctions took over and the main victim of this has been Europe, where a weak economy is facing the exogenous shock of severely disrupted supply lines.

As we previously wrote (https://mbmg-group.com/article/american-inflation-going-bananas) -

“To the extent that many of Ukraine’s exports can be substituted, the most obvious alternative source in many cases is Russia. While some sanctions had been threatened and even implemented in the months prior to February 24th (primarily by USA, UK, Germany, Australia, Japan and the EU), since then over twenty-five countries plus the European Union have implemented almost two hundred actions that amount to various sanctions. The combined effect of these has been to further disrupt the supply of goods, services and resources. Natural gas prices moved up from around $4.30 per million BTU (British Thermal Units) a week before the incursion, to $4.60 on February 24th,they subsequently fell back again to end February at $4.40. However, the effect of sanctions drove these to the highest levels in almost 15 years ($9.32) earlier this month. Although they fell back from this peak, they remain elevated and currently climbing again. In short, the inflation that we’re seeing was initially caused by supply shocks. It affected America far worse than most economies because of the US twin reliance on imports and consumption and because monetary and fiscal policy had underwritten consumption during the challenges of 2020 and 2021. The supply shocks were beginning to dissipate but were given a jolt by the escalation of the Ukraine-Russia conflict. This was abating, when it was driven exponentially higher by sanctions from NATO nations and their closest allies. The extent of the determination of these nations to continue to double down has slightly surprised us. The extent to which policymakers of these nations have cornered themselves has also surprised us. Policymakers have admitted that monetary policy is the wrong tool to use because it is ineffective to deal with supply issues and because in reducing aggregate demand, that will have limited impact on supply shock inflation but will reduce aggregate demand and cause the global economy to slow down, thereby risking causing a recession (which at such high levels of private debt has the potential to develop into a full-blown depression). Next time that Pres. Biden tries to pin the blame for this on others, we’d hope that FLOTUS Biden will send him one of her famous ‘fexts’ calling him out on this. Others have fact-checked Pres. Biden’s claims and reached similar conclusions, even though they admit that it’s tempting to scapegoat Pres. Putin at this time-

‘If I was Biden I would do the same. I would blame someone else external, that has nothing to do with me. Last year was Xi Jinping, this year it is Putin’ – Prof. Michele Geraci[i]

As always, politics is the main game in town, and as so often, risks causing extremely damaging consequences.

Doubling down on this, the western bloc has also imposed sanctions on China (presumably for allowing Nancy Pelosi to invade Taiwan[2]) and currently also has sanctions in place against twenty-six other countries including Ukraine (for misappropriation of state funds) and the USA (for extra-territorial application of legislation – i.e. running the world for the sole benefit of USA without at least pretending to consult the EU first).

However, we already covered much of this ground in Part One[3], so let’s conclude by noting, that the 2021-22 inflation episode has been driven by a combination of temporary supply factors (reopening existing capacity), demand compression (the reopening and stimulus effects of compressing demand timescales, even if aggregate volumes were within the capacity of the pre-pandemic demand cycle) and deliberate supply disruption through sanctions.

The demand wave seems to have normalised now and temporary supply challenges seem to have been largely mitigated at current demand levels (although there could certainly be additional issues reverting to full pre-pandemic demand levels, especially in ‘stickier’ supply situations, such as airports). However, the biggest short-term inflation upside risks remain the uncertainty of supply from the current areas of geo-political conflict, the risk of expansion of conflict and above all, the risks of politicians, especially European politicians, sacrificing their constituencies on the black altar of sanctions.

Long-term growth prospects remain subdued, creating conditions for long term disinflation or deflation, with aggregate activity still comfortably within aggregate capacity. However, this has to be tempered with the elevated risk of long-term supply constraints and even destruction due to heightened global military conflict or the impacts of climate change.

Should, as is emminently possible, both happen at once, then all bets, as they say, are off. However, above all, we should remember, that inflation is not the scary monster that policymakers would have you believe. Short-run inflation tends to barely make a mark in the bigger inflation cycles. Therefore, unless we are facing war or the costs of climate neglect (and we worry that we may be facing both), the longer term inflation trend is likely to resume it’s benign course:

The question then remains – will the consequences of the attempts to fight the mythical inflation monster be more damaging than inflation itself?

Please email us if you’d like the full reading list of sources used for this attempt to surf the 3 waves of inflation.

Now that’s done, we promise to move on to other topics.

[1] https://edition.cnn.com/travel/article/world-airports-most-summer-2022-delays-cancellations/index.html

[2] https://mbmg-group.com/article/dire-straits-type-a

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.