In part one (https://mbmg.substack.com/p/jerome-powell-is-a-chico-marxist) we looked at how the largest global economy casts an even greater, disproportionate influence over capital markets, by way of explaining why the behaviour of US capital has such an outsize impact.

“This planet has - or rather had - a problem, which was this: most of the people living on it were unhappy for pretty much of the time. Many solutions were suggested for this problem, but most of these were largely concerned with the movement of small green pieces of paper, which was odd because on the whole it wasn't the small green pieces of paper that were unhappy.” ―Douglas Adams, The Hitchhiker’s Guide to the Galaxy, describing Earth.

In this note, we pivot back from the fantasy games of capital markets back to the role of labour in both actual and financial economies:

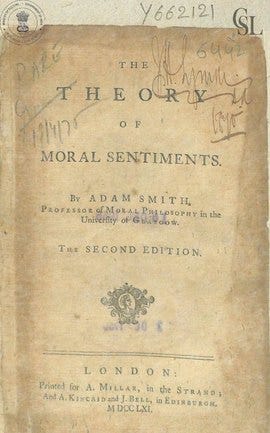

Labour has been long recognised as one of the major factors in economic activity, specifically in production. Adam Smith refers to land (and other natural resources) along with human input (labour) and capital stock (fixed capital such as machinery and working capital such as raw materials as components of the price of commodities, i.e. production (The Wealth of Nations, 1776 - which long-time readers may recall we consider as an invaluable source of insights albeit we have a strong preference for Smith’s lesser known The Theory Of Moral Sentiments).

Marx attempted to expand this understanding by focusing on the value added in the production process by the labour factor, highlighting the relationship between profit extraction by capitalists (i.e. owners/providers of capital), distinguishing between the amount of labour used in a particular production process and the potential stock of aggregate ‘labour power’ available to ‘capitalists’. Sadly, Marx was never able to produce a satisfactory method of calibrating the ‘transformation problem’ (essentially the quantification that holds good over time and different situations and industries of the breakdown of value-added by the different factors of production), although he did attempt to break it down in his later works.

Modern heterodox (i.e. non-mainstream) economists have sought to use empirical observations to better explain the factors of production. One example of this is Michael Hudson’s analysis of the role of profit distribution in the post-industrial age (i.e. the status of most economies in the Global North that have transitioned from heavy manufacturing to a more service-based economy) which has led him to observe “I deplore the "3-factor" theory. Land is NOT a factor of production; it's a rent-extracting opportunity.”

This comment is in fact a logical development of Adam Smith’s broadly suspicious attitude towards land ownership 250 years ago, but Smith tended to view the factory as successor to the farm in terms of being ‘productive’ land, whereas few modern, global businesses outside of the property sector itself look to own their premises as land tends to produce returns that are lower than those targeted by listed companies, especially companies with a growth bias.

Hudson has expanded on this by noting

“Neither money nor credit is a factor of production. Debtors do the work to pay their creditors. This means that interest is not a ‘return to a factor of production.’”

Equally Professor Steve Keen’s analyses have led him to recognise that in all aspects of modern economic activity, energy plays a key role, over and above the constraints of broader resources as a factor-

“labour without energy is a corpse, and capital without energy is a sculpture”

While mainstream economics has generally gone backwards in its aims to develop theories of value and production and therefore of labour, adding unhelpful misunderstandings to interpretations of the role of labour, capital and other factors of production within the global economy, in particular obsessing with the socio-politically motivated view of capital as being an accretive factor, combining with entrepreneurism (as opposed to the broader human or intellectual capital of a business) to generate technological progress as a central factor or production. Although this might seem superficially compelling, this is really just an extension of the myth promoted by extremists to justify unlimited exploitation of the majority by an ever diminishing few, which can be seen in the polemics of the likes of Ayn Rand (a deeply troubled, deeply hypocritical, rabid populist demagogue, scarred by childhood trauma, who spent her life trying to justify free-market imperialism by writing nonsense fiction in which e.g. business owners go on strike, resulting in their workforces gratefully accepting utter subjection.) She was also a close friend of and a major influence upon former Fed Chair, Alan Greenspan.

In the next part of this series, we’ll look specifically at the economic significance of labour.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit; it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledged all risks and have been informed that the return may be more or less than the initial sum.

Thanks for reading MBMG Flash! Subscribe for free to receive new posts and support our work.