Unspirational Speaking Part Three -

More thoughts from recent presentations....(the gift that keeps on.......)

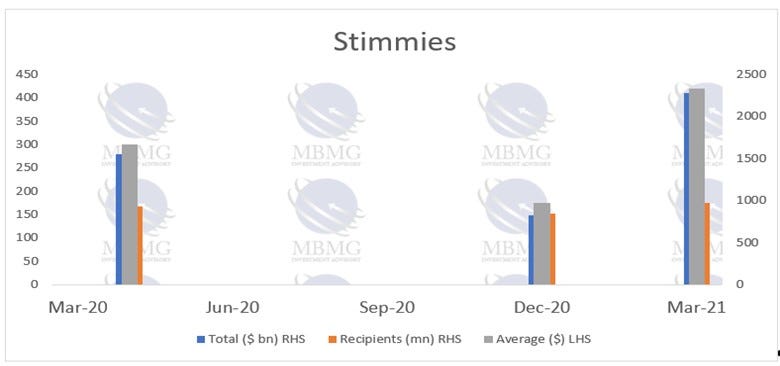

As mentioned in Part Two, this update will explain why the short-run inflation effect was more pronounced in economies where consumption was supported and encouraged by policy, the primary example of which was America. The influx of a total of almost $1 trillion[1] received in stimulus payments in 2020 and 2021 by 170 million individual recipients provided relief to households in financial distress but also created a dramatic discretionary spending uptake (and stockmarket and crypto speculation mania). The simultaneous arrival of the three incidents of direct stimulus payments into the bank accounts of the majority of Americans appears, on each occasion, to have had pretty immediate impacts on broad inflation:

This doesn’t mean that the concept of stimulus to support distressed families and the broader US economy was wrong. It does, however, ask questions about the execution. In particular by the time of the 3rd ‘stimmie’ there were already signs that broad-based consumption was at least starting to recover and that the concentration of this rebound into time periods compressed by lockdown and reopening and by transferring stimulus payments to almost all households in just 3 tranches was causing huge volatility in broad demand recovery.

While policymakers appear to have recognised this by providing a 4th stimulus in the form of monthly advances of child credit, it appears that a lot of non-distressed households still benefitted and engaged in discretionary spending. Future policymakers might wish to consider better ways to identify the spending priorities of recipients and ensure that stimulus is directed where it’s most needed. They also might want to consider whether spreading payments over more appropriate consumption periods might be more effective. In particular, the 3rd payment (which represented a distribution of over $400 billion to around 70% of American adults and the vast majority of American households, at a time when broad inflation was already beginning to ‘run hot’ may have not only been extremely questionable but also might ultimately have consequences that are harmful rather than helpful to those households facing the greatest economic challenges in 2022 and beyond, as policymakers have focused primarily on fighting the inflation that they played a major role in creating by injecting $1 billion into US consumer accounst so injudiciously that for a minority it was genuinely necessary and helpful but for a large number, it was just a means to upgrade to a new Peloton[2] or open a gamestop trading account at Robin Hood.

Some form of action was clearly necessary in 2020. Further action would no doubt have been welcome prior to December 2020 but was delayed by the petty party politicking of the 2 slightly different-flavoured self-interested organisations that run the kabuki theatre of US politics, the Dems and the GOP. By March 2021, this politicking had reached such a crescendo that it’s reasonable to question whether or not, the scale and scope of the American Rescue Act was really a vanity project by the Biden Administration, determined to make its mark, appeal to the middle classes and assuage the frustration at seeing its grand, but absolutely essential plans baulked to drag US infrastructure into the 3rd milliennium.

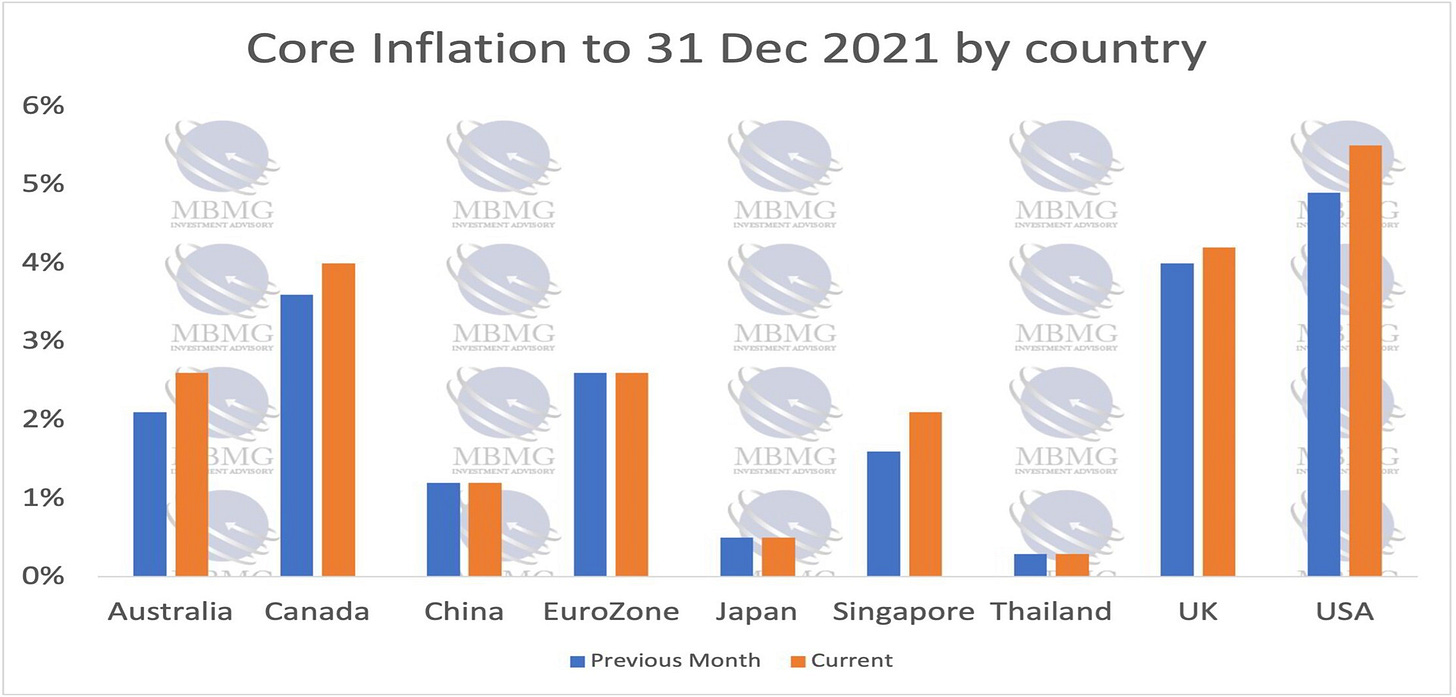

This explains why America, where the support and stimulus packages, at least in nominal terms, by far exceeded anywhere else. Arguably, too much, at least in the format that there were implemented. America suffered by far the worst inflation of any major economy[3] (although UK has subsequently been giving USA an inflation run for its money):

It was also among the worst of its neighbours[4]:

Again, we have to be very careful not to draw the wrong conclusions here, especially as politicians of all stripes will be keen to do exactly that: - with politicians we tend to have a defining syllogistic assumption:

1. One face good, two faces bad

2. With a few exceptions, all politicians

Ergo, almost all politicians are bad.

This generally stands us in good stead.

We believe that the right conclusions are

i. Stimulus was necessary but was generally badly enacted by policymakers, who just like automated supply chains, relied on models based on small deviations around the mean or the trend and not on any deeper understanding.

ii. Despite loud and ignorant claims to the contrary, we’d say that this largely vindicates the claims of our friends in the MMT movement, with whom we sympathise in terms of our understanding. A key tenet of MMT is that government money creation is not per se inflationary. It is what you do with the money created that is as important, if not more important than the simple scale of new mony created. This also chimes with another friend, Professor Richard Werner, , an often critic of MMT, whose Quantity Theory of Credit[5] places similar importance on the ‘purpose’ of money. We’d summarise the relevance of both schools after being dumbed down to our level by saying-

· It’s pretty obvious that if you create new money into the hands of individuals or institutions who will use that to invest, it will drive up the price (but not the value, except to the extent that perceived value reflects a feedback loop from price) of investment assets i.e. if you drop a few hundred billion Dollars into the accounts of bored, middle class Americans who have Robin Hood accounts and Reddit memberships and you’ll temporarily create meme stocks.

· It’s pretty obvious that if you create new money into the hands of solvent, liquid individuals locked down at home during a pandemic, they’ll engage into leisure activities that deploy that newly created credit – i.e. if you drop a few hundred billion Dollars into the accounts of bored, middle class Americans, peloton revenues will temporarily go through the roof.

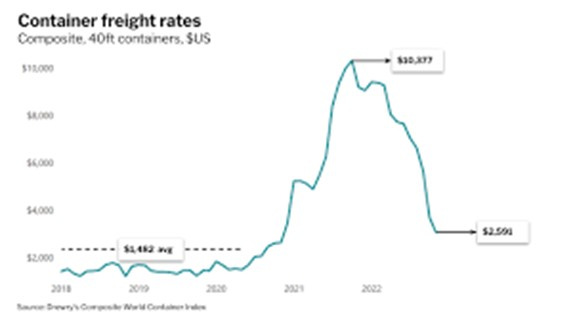

· It’s pretty obvious that if you create new money into the accounts of individuals, businesses and agencies following a lockdown during which the supply chain ground to a halt, the resulting demand surge will overwhelm lean logistical networks and infrastructure.

We’ll try to tie this all together in Part Four of Unspirational Speaking and then we’ll try not to talk about inflation again for a while.

[1] Payments to individuals under the 3 initial programmes (The CARES Act, the Consolidated Appropriations Act, 2021, and the American Rescue Plan Act), along with the monthly CTC payment from July to December 2021 represent less than 25% of total stimulus payments made and less than 20% of stimulus commitments by USG, with the majority divided into payments that were remitted to an “organization, business, or state, local, or tribal government” (https://www.usaspending.gov/disaster/covid-19?publicLaw=all)

[2] Weekly revenues for fitness device maker Peloton soared more than twelve times

during lockdown while around the time of the second ‘stimmie’ shares in video game retailer GameStop (GME:US) spiked from less than $3 per share to a brief peak at over $90 per share, largely fuelled by trades through online broker Robin Hood which doubled its active user base from 2019 to 2021 and in Q1 2021 saw its revenue increase 5 fold over the same quarter a year earlier https://www.businessofapps.com/data/robinhood-statistics/

[3] https://mbmg-group.com/article/mbmg-outlook-31st-january-2022-past-the-peak

[4] https://mbmg-group.com/article/american-inflation-going-bananas

[5] https://www.postkeynesian.net/downloads/Werner/RW301012PPT.pdf

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisors, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.