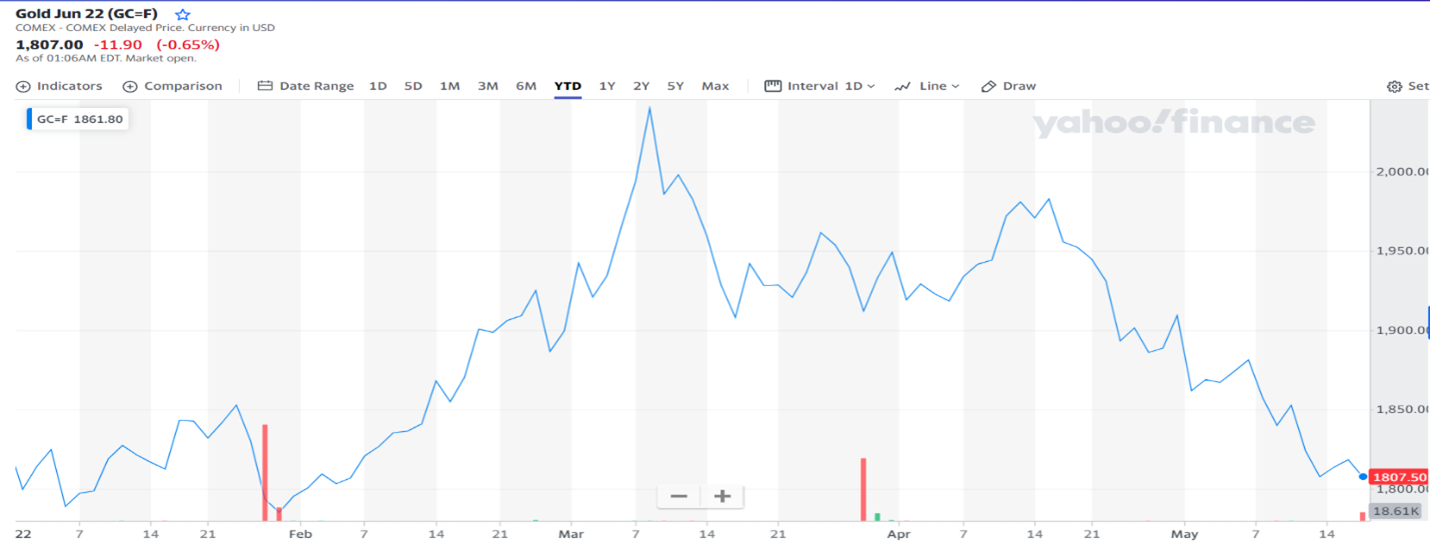

The price of gold is little changed from the levels at which it opened the year, although it did move higher in the first half of March, up by around 12.5% from the opening price in January, before slipping back again-

Gold price year to date (yahoo)

This has confounded some analysts who had expected the price of gold to move inexorably higher partly because of inflation, partly because of economic uncertainty and partly because of geopolitical uncertainty.

Gold isn’t a great inflation hedge

However, these expectations were based on misconceptions of how the price of gold has reacted to comparable events across a history that can be traced back almost 3,000 years.[1] We’ve pointed out on many occasions that gold is not a uniform, consistent hedge against inflation-

Gold is not a great inflation hedge. In early-stage inflation gold is actually a pretty poor hedge. Gold works best in two scenarios.

One is where you get really rampant inflation, but we’re not going to go from zero to 60 immediately.

And it also works where you get disinflation or deflation.[2]

It seems that because gold is such a powerful hedge against runaway inflation, many observers, despite the evidence, assume that this relationship is linear – i.e., that gold provides some protection against low levels of inflation, moderate protection against moderate inflation and a high degree of protection against high inflation. Historically, that isn’t the case – as stated above gold is an attractive asset during deflation and runaway inflation. During periods of inflation rising from a low base, gold has no great relative utility.

Why early-stage inflation is harmful to the price of gold

One reason that gold tends to underperform in early-stage inflation is related to interest rates. Gold pays no income or interest.[3] Therefore when interest rates rise, any assets that generate a yield become relatively more attractive than gold.

You can see this in the inverse relationship between the Federal Funds Rate (shown as the darker blue line at the bottom of the chart below) and the price of gold (the turquoise line in the upper half of the chart). Although there are multiple drivers of the gold price, we can see that any major direction in the Fed Funds interest rate, tends to cause an opposite reaction in the gold price.

Fed Funds rate (dark blue) compared to gold price (turquoise) over the last 2 years (yahoo)

Stronger USD impact on gold

As is often the case, the recent interest rate increases from such low levels have been supportive for the currency whose interest rates, or interest rate expectations, have moved up the most, in this case the US Dollar.

The US Dollar has increased in value against other currencies as US interest rate expectations have exceeded those of other currencies (partly because of the fact that USA has been one of the economies with the most severe supply shock inflation).

The Dollar index which compares the value of the Dollar to the currencies of America’s trading partners, has risen by around 3% in the last month alone. The price of gold has fallen by around 8% in that time Gold is typically more sensitive than FX rates as far greater volume of currency is traded or exchanged every day than is gold so you might compare this difference in scale to the difference that a large wave has on a small dinghy, compared to an oil tanker:

So, it’s not as much about gold price weakness as it is about Dollar strength.

Perhaps the most significant consistent drag on the price of gold has however been the combination of nascent supply shock inflation and higher interest rates. If, as we expect, these fall back, then the gold price may have a strong tailwind instead of a headwind.

What about the economic uncertainty?

We have long maintained that 3,000 years of history shows that the greatest protection value of gold is as a disaster hedge.[4] Gold performs exceptionally well during capital market crises, but not during less catastrophic episodes-

The value of gold as a hedge against market uncertainty could become more evident if conditions worsen from here, something that Mark Bristow, the CEO of gold mining behemoth, Barrick, has highlighted.[5] The global financial crisis can be dated back to 2007 but the price of gold initially moved higher as interest rates fell but only responded to the economic uncertainty when it rallied massively in 2009.

What about the geopolitical uncertainty?

Gold is an imperfect barometer of geopolitical tensions, mainly providing protection against extreme events in the same way that it is most effective against other extremities Gold may be an excellent hedge against a much bigger escalation of hostilities but it’s of limited value if the conflicts appear to be contained.

[1] https://www.academia.edu/29407918/MBMG_Research_Note_Gold_Mar13

[2] https://mbmg-group.com/article/dilemma-between-liquidity-fueled-bubbles-copy

[3] There can be a small yield derived from using gold for securitisation, i.e., lending it, but this has generally diminished in relative importance in the last few r interest rate decades.

[4] https://www.academia.edu/29407918/MBMG_Research_Note_Gold_Mar13

For any more background on these points or to ask us any questions, don’t hesitate to drop us a line.

Sign up for MBMG newsletter from Co-founder & Managing Partner Paul Gambles

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.