It’s said that a rising tide lifts all boats.

This is often quoted by capital market participants during calm periods when seemingly all assets are increasing in price (which ceteris paribus should be the default position in a growing global economy….except that all things are never equal…)

However, we can disprove this in just 2 words:

Cathie Wood

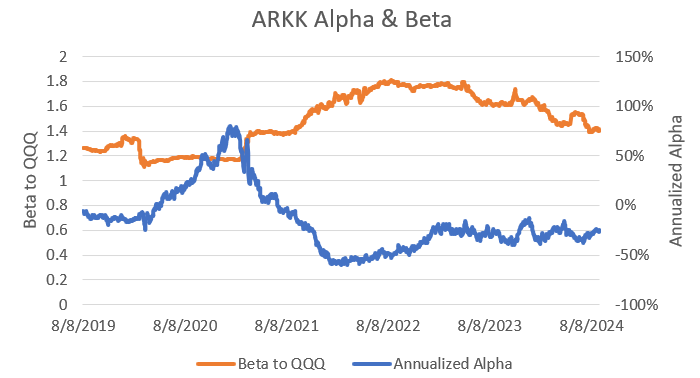

A graph dissecting how much value the once popularly vaunted, but also (by us at least1) vilified mis-manager of the Ark suite of ETFs adds to investors shows that over the last 5 years the annualised added performance (i.e. Alpha) of ARKK (Ark’s flagship fund) was positive (the blue line and right-hand axis) for around a year (from August 2020 to August 2021)

Throughout the rest of this period, ARKK basically detracted from whatever returns the market was offering - in other word for 80% of the time Cathie Wood’s impact has been to destroy the value of ARKK relative to the returns available from the market. In case you think that destroy is too harsh a term, for the last 2 years the cost of having Wood manage your tech investments (as opposed to the technology ETF QQQ) has been around -25% a year. Before that it was worse - troughing at -50% annualised in 2022. Throughout those 3 years, the volatility of ARKK averaged around 50% higher than the market.

In other words, consistently placing high risk bets that generally went wrong.

A rising tide can’t lift all boats - not one where the captain keeps aiming for all the treacherous reefs and rocks. Maybe this is why there are so many images of Ms. Wood in devotional poses - may God bless and protect passengers who sail on this ARK…God knows, they’ll need it!

H/t to Michael Green of Yes, I give a fig for the chart.

MBMG Investment Advisory is licensed by the Securities and Exchange Commission of Thailand as an Investment Advisor under licence number Dor 06-0055-21.

For more information and to speak with our advisor, please contact us at info@mbmg-investment.com or call on +66 2 665 2534.

About the Author:

Paul Gambles is licensed by the SEC as both a Securities Fundamental Investment Analyst and an Investment Planner.

Disclaimers:

1. While every effort has been made to ensure that the information contained herein is correct, MBMG Investment Advisory cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Investment Advisory. Views and opinions expressed herein may change with market conditions and should not be used in isolation.

2. Please ensure you understand the nature of the products, return conditions and risks before making any investment decision.

3. An investment is not a deposit, it carries investment risk. Investors are encouraged to make an investment only when investing in such an asset corresponds with their own objectives and only after they have acknowledge all risks and have been informed that the return may be more or less than the initial sum.

e.g.

Capital Contagion - It goes where it impacts the most- https://mbmg.substack.com/p/mbmg-ia-flash-capital-goes-viral

Capital goes viral- https://mbmg.substack.com/p/mbmg-ia-flash-capital-goes-viral

Talking Points- https://mbmg.substack.com/p/talking-points

⚡SEEN THIS MOVIE BEFORE #7 (https://mbmg.substack.com/p/mbmg-ia-flashseen-this-movie-before)

Liquid lunge – Seen this Movie before- (https://mbmg.substack.com/p/liquid-lunge-seen-this-movie-before)