Interest Rates Stand Still

Earlier today(22nd March), Paul chatted with Andrea Heng, the anchor CNA’s flagship morning news programme, Asia First. A major topic was Wednesday’s FOMC (Federal Open Market Committee) meeting. The meeting and subsequent press conference had been a relatively muted affair: As expected interest rates remained unchanged although the FOMC’s updated economic projections were unveiled on Wednesday. These included a revised ‘dot plot’ of future interest rate policy decisions, which showed that FOMC members continue to expect there to be three rate cuts (understood to be of -0.25%) in 2024 but fewer rate cuts in 2025-2026 than had been dot-forecasted in December last year. They also indicated that the rate of GDP (Gross Domestic Product, a widely used, almost universally misunderstood and utterly unreliable proxy for economic activity) growth is now expected to be higher this year than officials had previously estimated.

Inflation's Rocky Road

To understand why we think that these numbers are as reliable as my infuriating but sorely missed 1990s Italian sports car, please visit https://mbmg.substack.com/p/episode-1-unveiling-the-mirage-of and https://mbmg.substack.com/p/episode-2-behind-the-economic-veil

The FOMC also noted that they now expect “core” inflation (excluding volatile food and energy prices, because who needs food or energy?) to be higher than previously anticipated, seemingly reacting to higher housing and sharply higher energy costs, that resulted in a higher than expected non-core inflation reading in February, but as even FOMC Chair, Jerome Powell recognises, the journey back to the 2% inflation target is expected to be bumpy.

Market's Sigh of Relief

Relieved that Powell and his cohorts (the people whose policy mistakes helped create the inflation fears that have dominated the global financial landscape for the last 3 years or so) hadn’t said or done anything irreparably stupid, the main US stock indices (S&P 500, Dow Jones Industrials, NASDAQ Composite) and others rallied to all time highs. Paul, however, was less than enthused:

“Everybody's taking their cue from what Powell said or rather didn’t say on Wednesday. Fed meetings have now become an event where the key issue is whether Powell and the FOMC Committee are going to say or do anything really, really stupid or not. Hopefully, most times they won't. Certainly on Wednesday, they managed to not to put their feet in their mouths. Because of that we all came away with a degree of positivity. Markets responded positively. With energy the oil price largely held the gains of the recent price move upwards.

The Economic Crystal Ball

The real problem here though is that if you look at the track record of policymakers over a long term, they’re generally not very good at telling when the economy is slowing down, not even predicting when it will slow but even actually sensing when the economy has already slowed down. We recently did a deep dive into this (“The Myth of Soft Landings” was recently shared with MBMG clients and a summary will be added to Substack in the coming weeks) and found that historically policymaker were generally saying ‘don't worry, everything is fine’ even after slowdown and recession had already started. So it (a late-stage, post-rate-hike cycle, policymaker-fuelled asset price rally) is certainly not something that we would buy into. It's not a rally that we would trust in terms of stocks and in terms of commodities. So I wouldn't be buying oil at this price. There are some supply and inventory issues (Cf https://www.cnbc.com/2024/02/06/oil-prices-today.html), but I think demand is only likely to get weaker from here.”

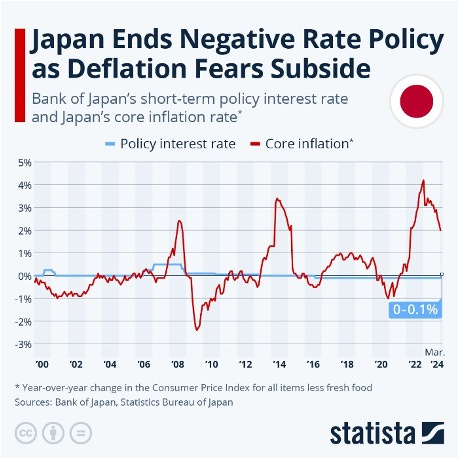

Andrea moved the conversation to Japan, where policymakers had increased the main policy interest rate from a range of 0% to -0.1%, to a new range of 0% to +0.1% and indicated that future policy is dependent on the ‘confirmation of stable inflation’. Andrea asked what stable inflation in Japan might look like.

A Slight Nudge in Japan

Paul acknowledged that there are short term issues in Japan in that but after years of deflation saw the recent move up in inflation, while remaining both anchored and moderate as “positive in that we've seen inflation move higher, and we've seen wage inflation move higher which is probably the most significant factor.

Source: https://www.statista.com/chart/31930/japan-interest-rate-and-inflation/

There's a lot of signalling going on here; I don't think that anywhere else in the world a 0.10% increase in interest rates would have the same sort of fanfare or impact that it's had in Japan. But obviously, the key here is that it's taken us from, very slightly in the negative bound to vary slightly in the positive bound. So people are seeing that is being a huge event but . I don't necessarily think it's that huge.

I suspect that we're close to the peak in Japanese interest rates for a while. Whatever Japanese policymakers are saying, I think they're going to end up moving to much easier policy. Not as alarmingly as in the States, we are starting to see signs of slowdown in Japan which will likely see rates move softer (i.e. lower) going forwards.

It’s almost reminiscent of the Fed having to raise interest rates (having pursued Zero Interest Rate Policies [ZIRP] following the GFC) in order to be able to cut them again. I think there's an element in Japan that policymakers wanted interest rates to move into positive territory because they're going to be, they're going to be cutting rates, not hiking rates going forward.”

Andrea then asked about opportunities in relation to currencies (or Foreign Exchange, FX). Paul explained his view that Yen is hugely undervalued adding “to some extent US Dollar is overvalued but probably not to the same extent as Euro. There are an awful lot of dynamics at play in all FX markets” Paul added that the Singapore Dollar is likely to remain stable but that the outlook Asian currencies in general is fairly positive and that Asian policymakers are in a good space in that weak currencies are generally helping, economic performance, especially export performance, while supporting asset prices, providing support for local stock markets. “Asian policymakers have been in a good place, but that space is likely to diminish.” Paul expects strengthening of Asian currencies, which means that relatively short-term, high grade Asian sovereign bonds are likely to become better value than Asian stocks because the combination of higher interest rates (while unhelpful for bonds) and higher FX rates could pose something of a barrier for risk assets going forwards, but Asian currencies have upside potential.

Andrea then switched focus to China, highlighting hints from the Chinese central bank (the PBoC or People’s Bank of China) about increasing liquidity for banks, through mechanisms like the RRR Ratio (the so-called ‘Triple R’ ratio is a mechanism that constrains bank credit creation through new lending). Asked how much space the Chinese central bank has to relax policies, Paul replied “Almost Infinite. The PBoC have taken some degree of criticism in recent years but mainly from outside China. In my view, they've kept a really steady hand on the tiller. We haven't seen the massive knee jerk reactions from Chinese policymakers that we see from Western policymakers. I’d like to see some sort of Academy open where Chinese policy makers teach people like the Fed how to how to run economic policy. I think China has got it under control and I think we will just see a very gradual approach and a slow return to sustained, higher levels of growth, while inflation remains very much under control. Real growth numbers (i.e. economic growth adjusted for inflation – for an explanation of this concept, please see https://mbmg.substack.com/p/episode-2-behind-the-economic-veil) in China are still attractive. We just see gradualism. The idea of China with double digit real growth is obviously a thing of the past and obviously a number of issues have needed to be fixed. The property sector is partially fixed, but there's still some work to do on that. Rather than the western policymaker approach of creating a replacement boom in another sector or another property boom, they seem to be putting a floor under it, rather than putting another rocket underneath it. We expect stable, sensible, sustained, consistent return to growth in the Chinese economy and to stability in the property sector in China. The focus on exports has shifted to more of a focus on domestic consumption which is why we remain, especially the two areas that we really like, Chinese technology and Chinese domestic consumption. There is an increasing relationship between those. A lot of technology has a consumption, especially consumer discretionary focus, but also, the way that American lawmakers generally are reacting these days, which is the way that American lawmakers have reacted (across different sectors) throughout American history, is to seek to secure US market leadership through aggressive and extreme protectionism in the technology space right now. So technology is becoming an increasingly domestic play at the same time that Chinese policy is increasingly focused on stimulating sustained domestic consumption.”

US-China Tech Tensions

Paul’s reference to American lawmakers highlighted the legislation currently in process involving the Tik Tok app owned by Chinese company, ByteDance (Cf https://www.aljazeera.com/news/2024/3/14/why-has-the-us-passed-a-bill-to-ban-tiktok-and-whats-next) . This is the latest scenario in which US political interests have sparked national security fears that companies like ByteDance (and previously Huawei, ZTE, Hikvision etc – cf https://www.npr.org/2022/11/26/1139258274/us-ban-

tech-china-huawei-zte) by claiming that these companies, and the data that they hold, could be secretly controlled by the Chinese Communist Party. In reality, USG using commercial channels to spy on allies and enemies alike is now so commonplace that it seems to have become universally accepted. (https://www.nytimes.com/2023/04/13/us/politics/us-spying-allies.html)